The Story of Rising Fertilizer Prices

Fertilizer prices approximately doubled between the summer of 2020 and the end of 2021. High fertilizer prices hurt farmers' pocketbooks, especially for fertilizer-intensive crops such as corn. The Russian invasion of Ukraine may further drive up prices, although this has not happened yet as far as I can tell.

This week, I published an article in ARE Update1 on the story behind the run-up in fertilizer prices. Read it. It's only four pages.

In this week's Ag Data News, I repeat the punchline of that article and provide some additional perspective.

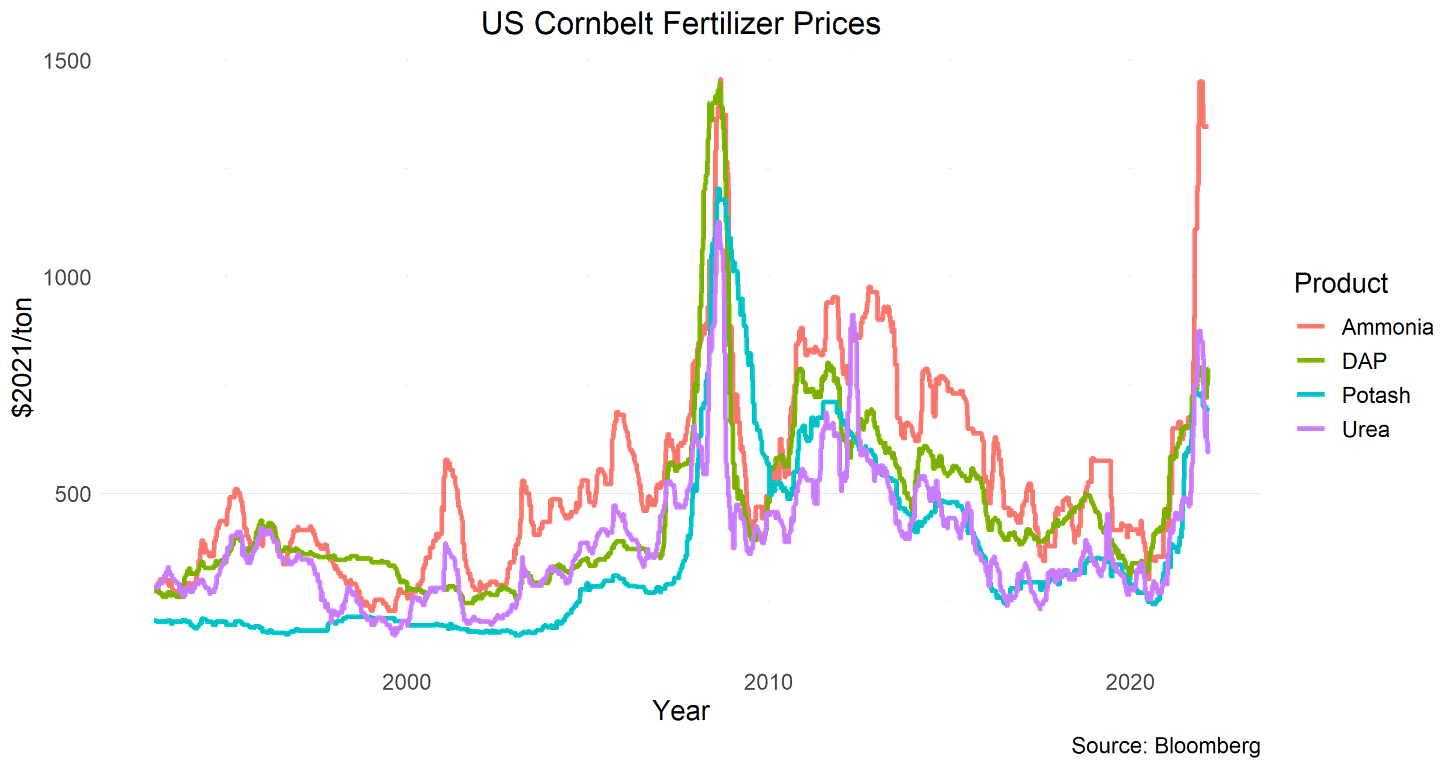

There have been two fertilizer price booms in the past 30 years: 2008 and 2021. For most products, real prices peaked at much higher values in the previous boom. The graph below shows prices up to March 2, 2022 (today), so they show no sign of a jump following the Russian invasion.

Background on fertilizer

Most fertilizers deliver one or more of the following macronutrients to plants: nitrogen (N), phosphorus (P), or potassium (K).

Nitrogen makes up three-quarters of the air we breathe and is essential in plant growth. However, atmospheric nitrogen needs to be converted to ammonia (NH3) before it is accessible to plants. The invention of the Haber-Bosch process in 1909 enabled the production of synthetic ammonia by reacting nitrogen with hydrogen under high heat and pressure. U.S. nitrogen producers use natural gas as an energy source in this process.

Phosphorus helps plants grow by promoting photosynthesis and other functions important for development. Phosphorus fertilizers are typically produced by mining phosphate rock and treating it with sulfuric or phosphoric acid, causing a chemical reaction that converts it to a form that can be absorbed by plants.

Potassium strengthens plants, making them resistant to disease and higher in quality. Potassium fertilizers are created by mining potash from deep underground, similar to table salt. Chemical reactions convert it into a form usable by plants.

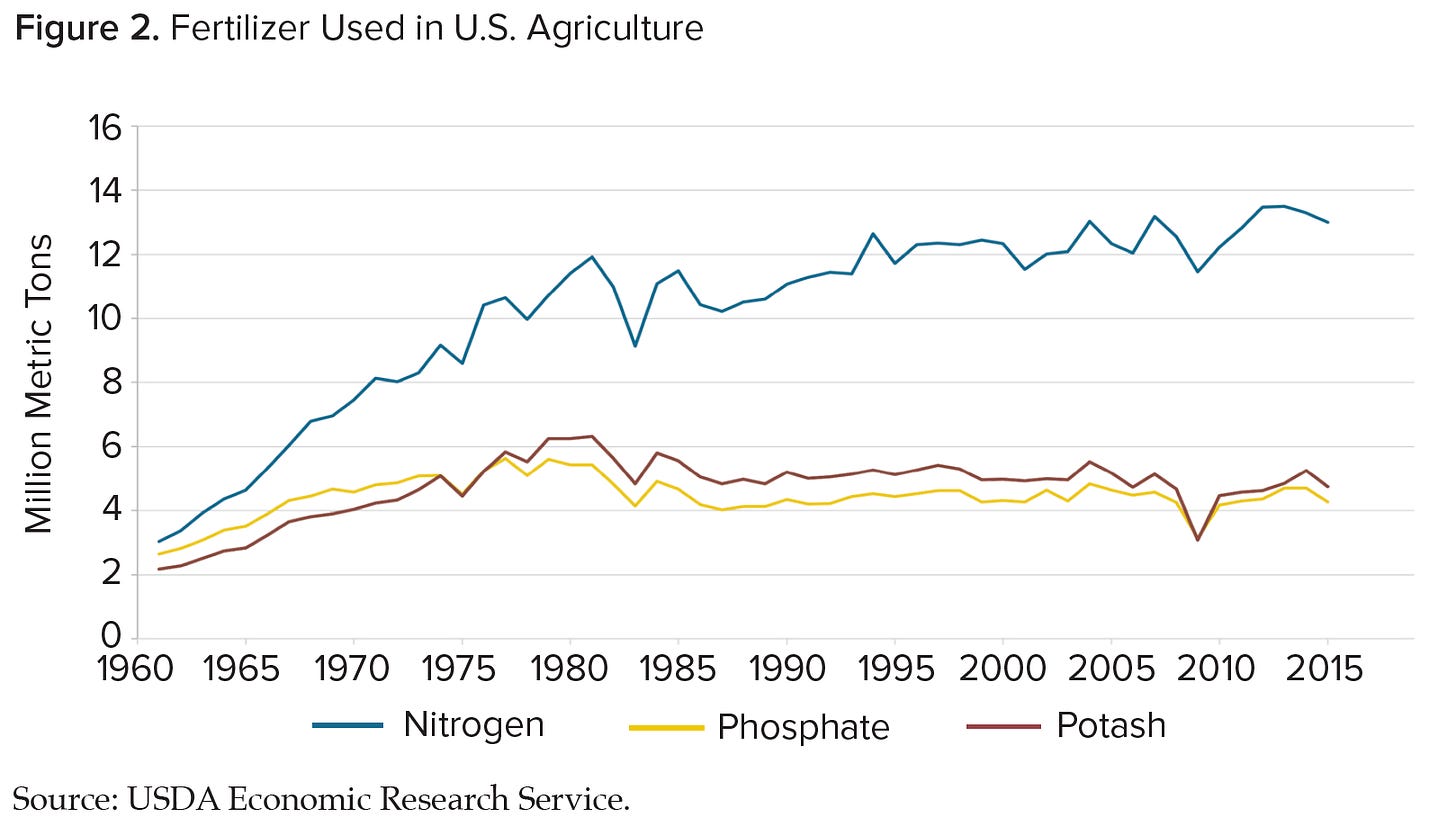

US nitrogen fertilizer use increased by a factor of four from 1960–1980. This increase coincided with dramatic increases in crop yields. In the 1970s, high agricultural commodity prices created a farm boom in which farmers planted more acres to crops and increased fertilizer applications. Phosphate and potash use has been relatively constant since 1985. Use of all fertilizers dropped substantially in 2009 after fertilizer prices increased fivefold during the 2008 commodity boom—a much larger increase than in 2021.

Why did fertilizer prices increase in 2021?

Both supply- and demand-side factors contributed.

On the supply side, U.S. natural gas prices doubled between the summer of 2020 and the end of 2021, which significantly raised the cost of nitrogen production. Energy is also a component of phosphate and potash mining costs, but it is much less important in the production of these products than for nitrogen. For this reason, the increasing price of natural gas cannot fully explain the fact that all fertilizers increased in price by a similar percentage.

Also on the supply side, shipping costs increased dramatically in 2021, especially on shipments from Asia to North America. However, most fertilizer imports to the U.S. come from the Americas and would be less affected by shipping costs.

On the demand side, crop prices are high. Corn, soybean, and wheat prices increased by 60% from the summer of 2020 through the end of 2021. High crop prices incentivize farmers to apply more fertilizer per acre, which would place pressure on fertilizer prices.

How does Russia's invasion of Ukraine affect fertilizer?

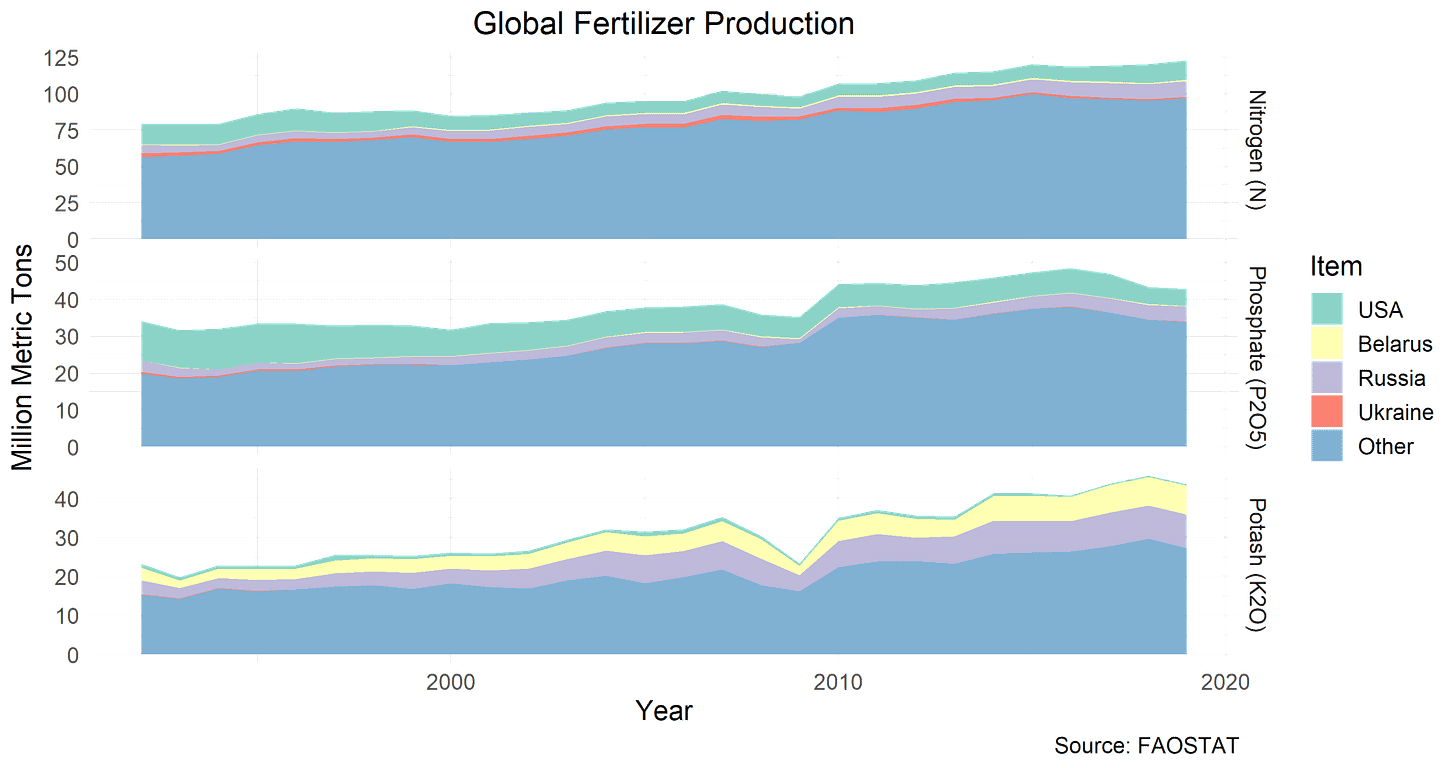

Fertilizers are produced throughout the world and traded heavily between countries. Russia produces 9% of global nitrogen fertilizer, 10% of global phosphate fertilizer, and 20% of global potash fertilizer. It exports more than two thirds of its production of each product. Belarus produces an additional 17% of global potash and exports almost all of it.

If sanctions cut Russia and Belarus off from world markets, then it will leave a hole that other producers will need to fill. China produces almost all of the nitrogen and phosphate it uses, so it will not absorb Russia's exports. However, the apparent lack of a post-invasion price spike suggests traders are not yet worrying about a global shortage of fertilizer.

Ukraine produces only a small amount of fertilizer.

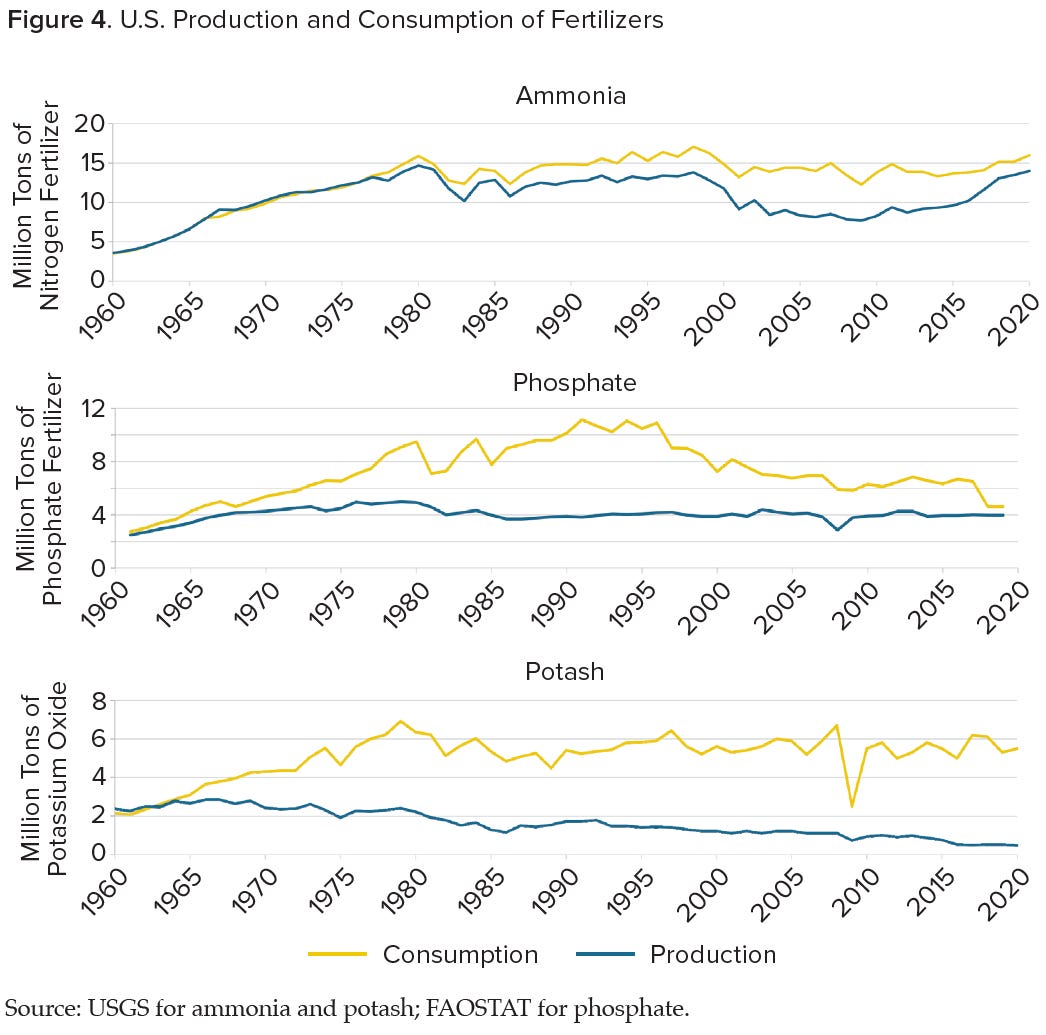

The United States currently produces about 85% of the ammonia it uses, most of which becomes nitrogen fertilizer, and it produces 90% of the phosphate rock it uses, most of which becomes phosphate fertilizer. It imports 90% of its potash, mostly from Canada.

The outlook for 2022

Predicting commodity prices is a fool’s errand. When natural gas and agricultural commodity prices come down, I would expect fertilizer prices to also come down. I don't know when that will be.

When the price of a pound of fertilizer exceeds the expected increase in revenue from spreading it on the field, it is not profitable to use that pound. Fertilizer prices have increased by more than most crop prices, so in 2022 producers have an incentive to apply less fertilizer per acre.

If farmers do apply less fertilizer per acre, it will provide an environmental benefit in the form of less nitrogen and phosphorus in streams, rivers, and lakes.

Moreover, to the extent that farmers currently apply more than the recommended amount of fertilizer as insurance against low yields, reducing use in 2022 provides an opportunity to experiment and to learn how much such insurance is necessary.

ARE Update is a bimonthly magazine published by the University of California Giannini Foundation of Agricultural Economics for the purpose of providing wide dissemination of research results and expert opinion from faculty, CE Specialists and graduate students in agricultural and resource economics at UC Davis and UC Berkeley. The current issue features articles by Olver and Zilbermanon on how soil fumigation changed the strawberry industry and by Hilscher, Raviv and Reis on inflation risk.