The Indian Price Support Conundrum: To Phase Out or Out of Phase?

This article was written by UC Davis ARE PhD student Raghav Raghunathan. It is the fourth of six excellent articles written by students in my ARE 231 class this fall.

Agricultural markets both globally and regionally are highly distorted by government intervention, especially in developing regions such as the Indian subcontinent and sub Saharan Africa. Agricultural markets in these economies experience multiple policy interventions, creating perverse incentives that either suppress or amplify production. I highlight one such example in this article: public procurement of farm produce, mainly wheat and rice, in India.

The Indian government procures nearly 40% of all domestically produced wheat (110 million tonnes) and rice (125 million tonnes) with an annual budgetary outlay of $37 billion. The goal of this policy is to provide farmers a minimum support in case market prices are below the support prices. Supporting prices might be well warranted given that small and marginal farmers sell to tremendously powerful intermediaries.

However, vast disparities exist in regional concentration of such procurement. In western states like Punjab and Haryana, nearly 90% of all of rice and wheat procured is bought by the government at minimum support prices whereas in eastern states like West Bengal only 5% is procured. Moreover, poorer districts where farms are smaller tend to have lower government procurement rates than richer districts where farms are larger.

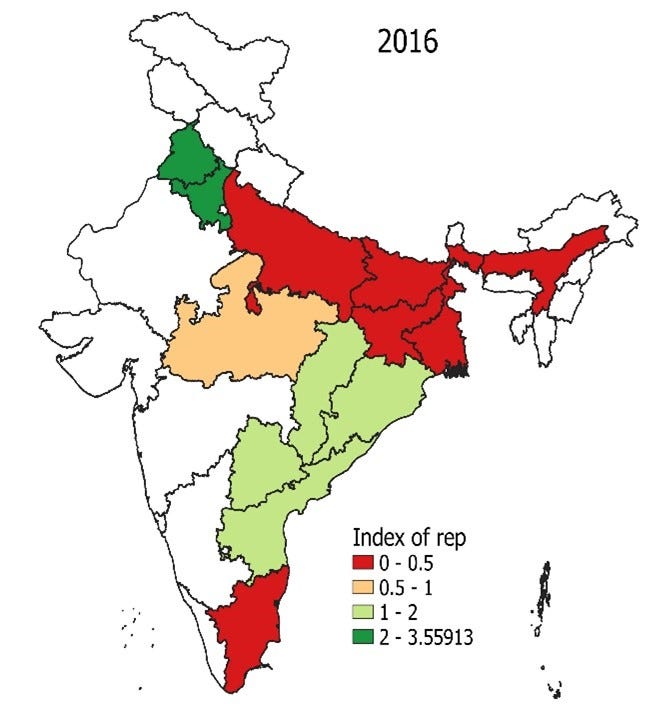

To show how procurement varies, I use data from the Food Corporation of India, which conducts much of the procurement, and annual production data, I construct an index of representativeness. The formula is

This index exceeds one if a state’s share in national procurement exceeds the state's share of national production, and it is less than one if a state’s procurement share is less than the state’s production share. The idea is that a state's procurement is over represented if its share of production is in excess of its share in production.

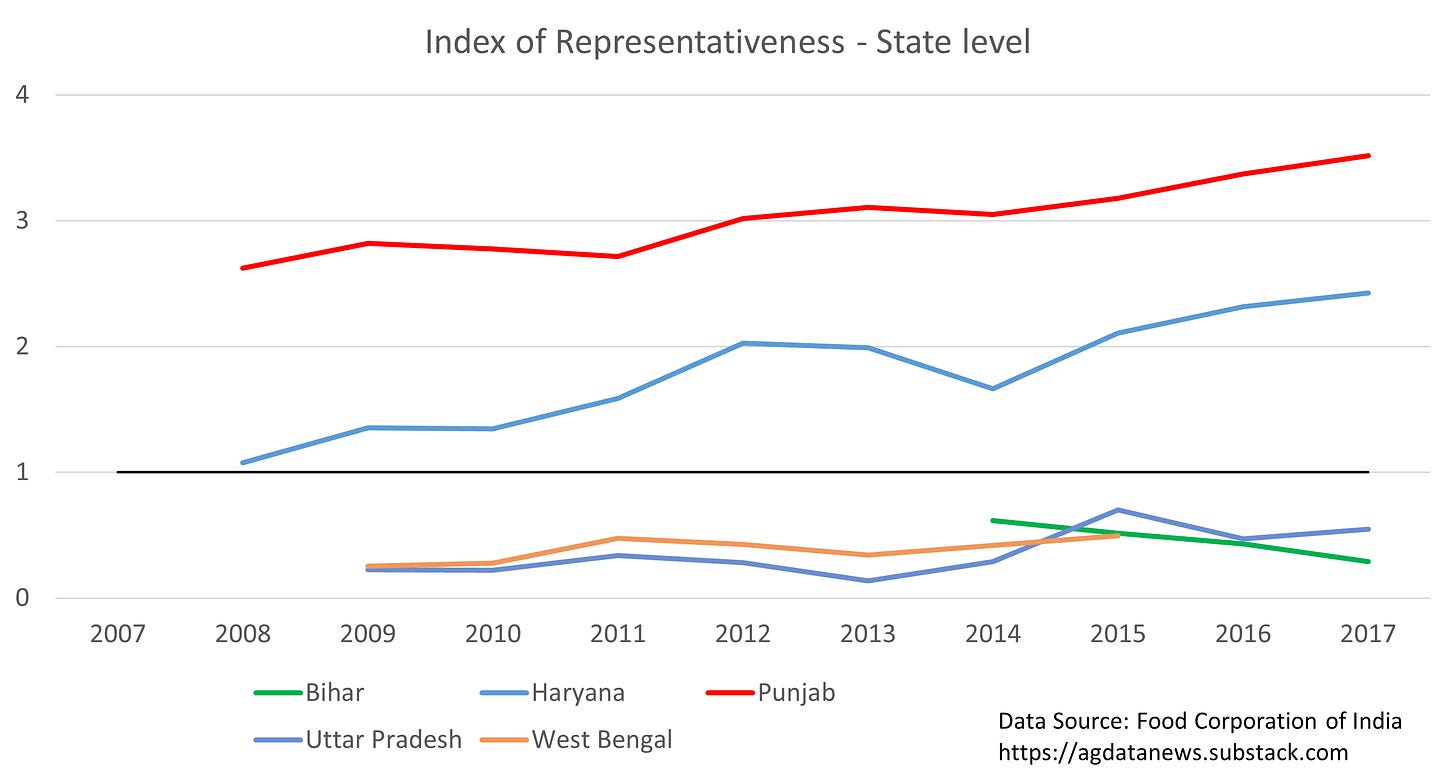

Punjab and Haryana account for 15% of total rice production but use up 34% of national procurement whereas states like Uttar Pradesh, Bihar, Jharkhand and West Bengal and Assam which account for 40% of rice production account get only 14% of procurement.

I plot the index of representativeness across time and its spatial distribution. Not only is it ~600% higher than states such as Uttar Pradesh for these two states but they also are increasing over time while for the other states the trend is either flat or decreasing.

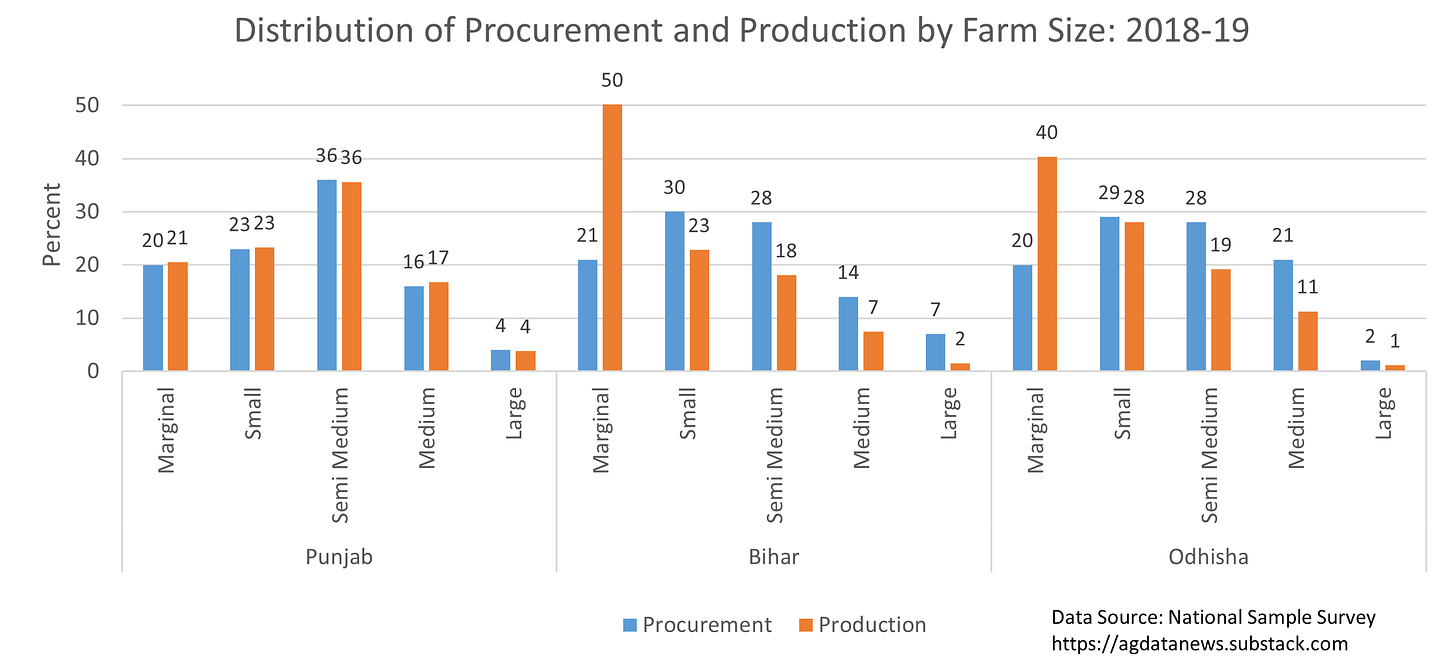

Data from the National Sample Survey shows that small and marginal farmers are vastly under represented in their access to support prices, even after adjusting for share of produce sold.

Punjab has similar share of quantity sold to share in procurement across farm sizes. However, in Bihar marginal farmers contribute to 50% of quantity sold, but only 21% are selling at support prices. Support prices are at least 20% higher than market prices, so there is a regressive distribution of subsidy through procurement where the richer states, larger farmers benefit much more than the poorer states.

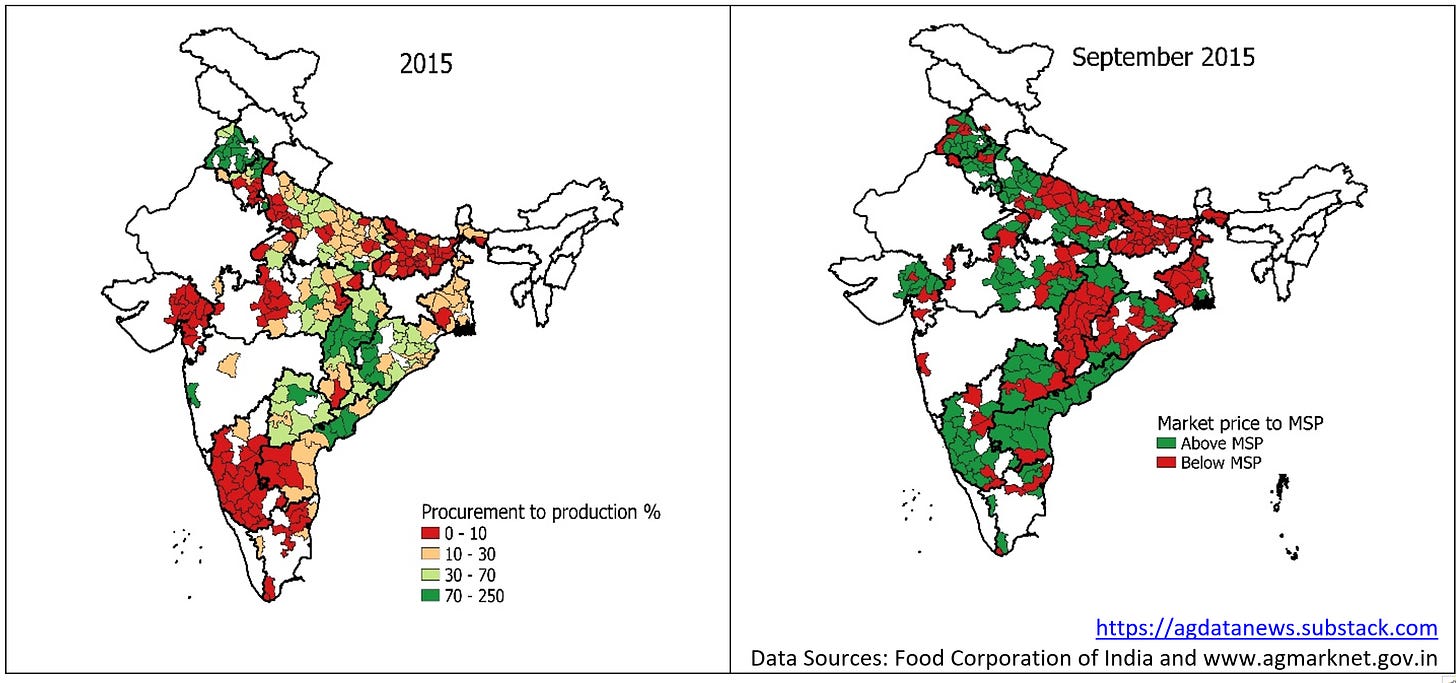

Western districts such as those in Punjab have high procurement shares and higher prices than the support price. In contrast, eastern districts such as those in West Bengal have low procurement shares and market prices lower than the support price. The correlation between procurement shares and prices is less obvious in the South, where procurement shares are low and prices are above the procurement price. A discerning academic study could point to a threshold level of procurement that could have a stabilizing effect on prices.

Could government procurements be redistributed to rise prices closer to competitive levels in states like Bihar, West Bengal and Uttar Pradesh without reducing prices in states like Punjab? Shifting some procurement to the east could help farmers combat buyer power, and private players may step in to replace lost government procurement in the west. Technical projection of prices due to redistribution is beyond the scope of this article, but it seems quite clear that the benefits of even marginal redistribution could outweigh the costs.

For more information on the data used in this article, please contact Raghav.