Discover more from Ag Data News

The Gas Tax Holiday is a Bad Idea

This week, the Biden Administration proposed to suspend federal gasoline and diesel taxes to relieve pressure on consumers facing high fuel prices. They proposed to eliminate the 18c per gallon gasoline tax and the 24c per gallon diesel tax for 90 days.

From an economic perspective, this is a bad idea.

Two weeks ago, I wrote about how elasticities matter for understanding the benefits of international trade. This week, elasticities will tell us why this tax holiday is a bad idea.

When the government imposes a sales tax, the least elastic side of the market will pay the tax. When the government removes a tax, the least elastic side of the market will reap the benefit.

To understand why, let's think about what happens when the government removes a sales tax. Eliminating the tax means suppliers face lower costs per gallon of fuel they sell. With lower costs, they are making more profit per gallon, so they try to increase production. They might as well capture the available profits before their competitors do.

Elastic supply means they can increase production. Suppliers will flood the market until the price comes down and there are no longer profits sitting on the table. Consumers benefit.

Inelastic supply means they can't increase production. They will just keep producing what they were producing. There's no more production, so the price doesn't drop. Suppliers benefit.

Is the supply of gasoline and diesel currently elastic or inelastic?

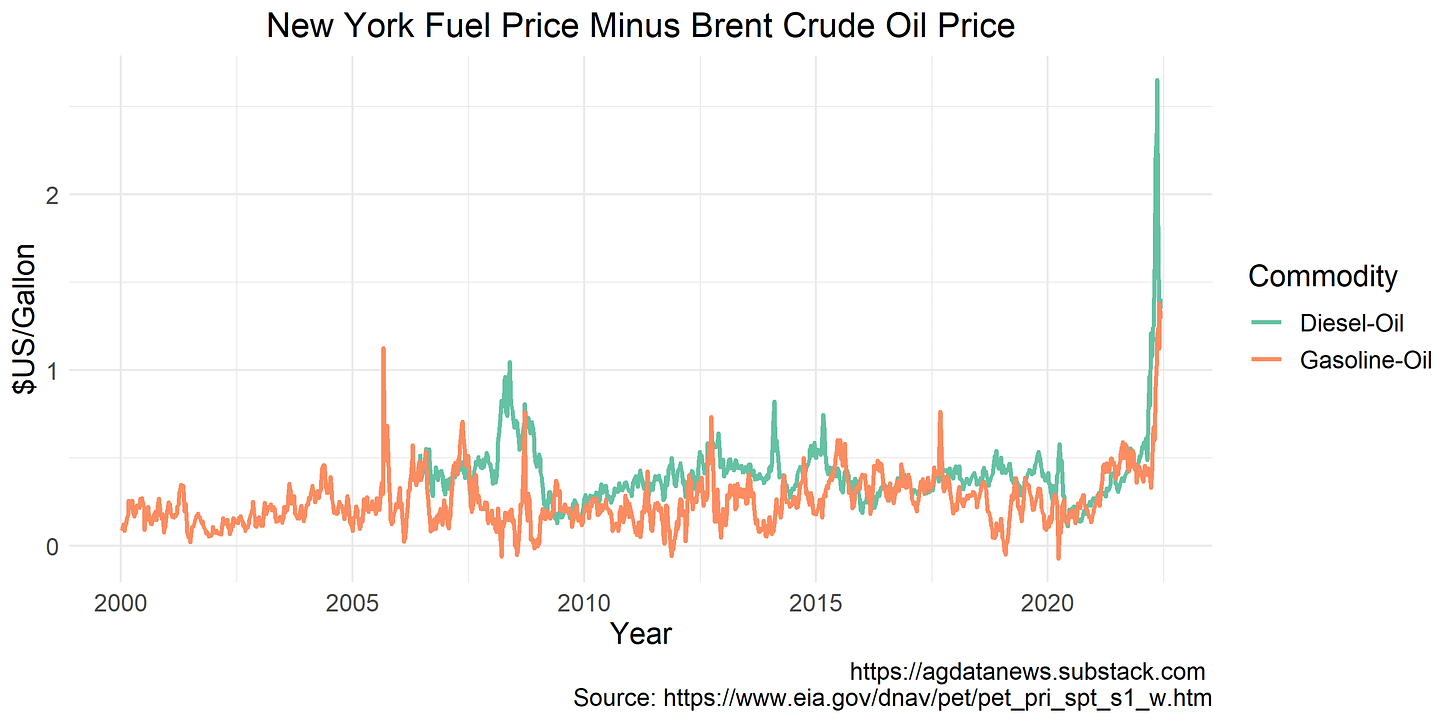

This chart answers that question. It shows the difference between the price that oil refiners sell their products for and the price that they buy crude oil for. This gap is usually less than 50c per gallon, but it has exploded to $1.50 or more in the past couple of months. This tells us that refiners are at capacity. They would like to produce more, but cannot.

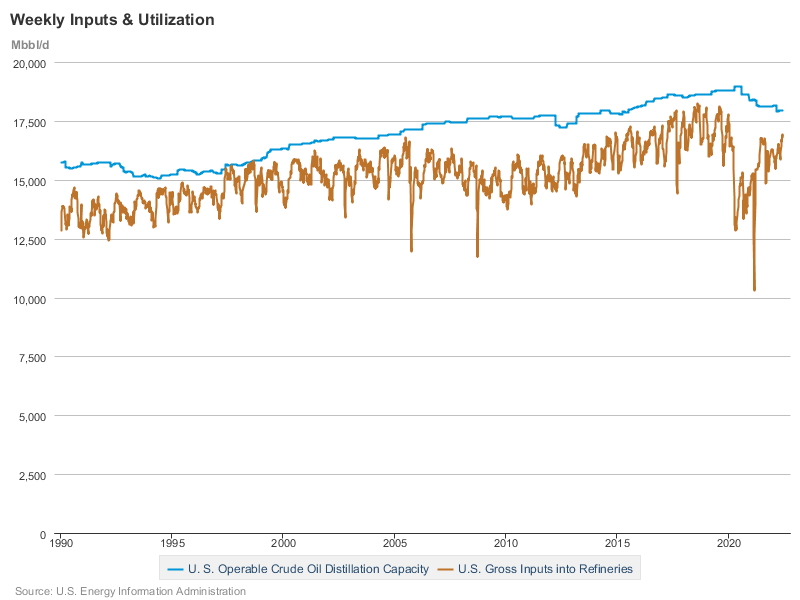

The Department of Energy measures refinery capacity. In the past two years, refinery capacity has declined by about 5%. Some of this decline is due to California refineries closing and re-purposing to produce renewable diesel. In the most recent week, refineries nationwide were using 94% of capacity, which suggests they may be able to produce more. However, the fact that capacity utilization almost never gets to 100% suggests that this last few percent of capacity are hard to utilize. The spike in refining margins is consistent with this interpretation.

The Biden Administration has asserted that refineries are not at capacity, but are instead exploiting consumers and enjoying unreasonable profits. It is possible this is true. Earlier this year, I wondered whether meatpackers were doing the same thing, although I was not convinced by the evidence.

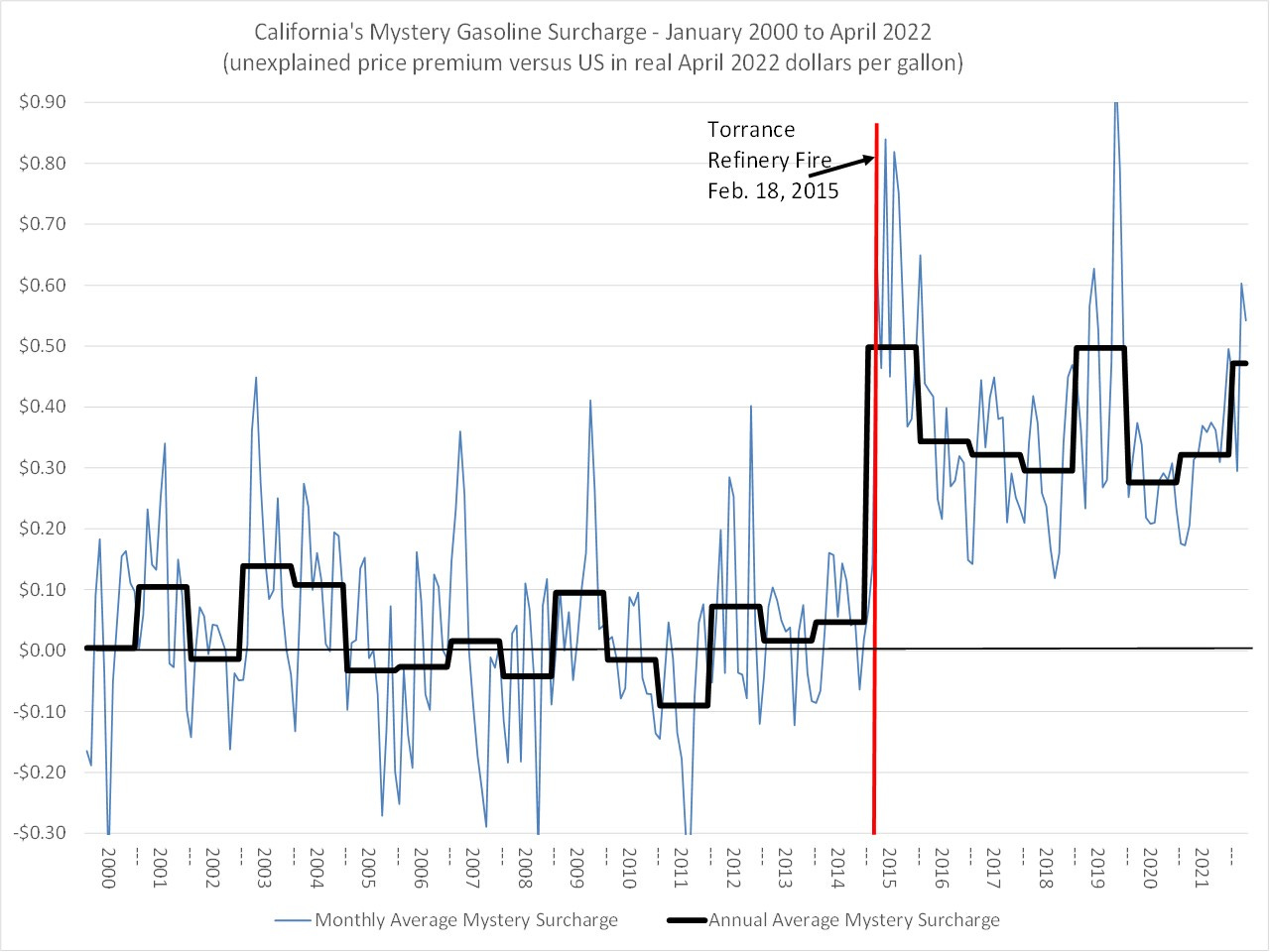

Something similar does appear to have happened in California recently. In February 2015, there was a fire at an oil refinery. Gas prices went up by $0.40 per gallon and stayed there after the refinery started back up. In the last 7 years, fuel suppliers appear to have ripped off Californians to the tune of $40b. That's $1000 per person in the state.

The standard retort to arguments that oil refineries are behaving anti-competitively is "why now?". If they had the power to exploit consumers like this, why are they doing it now and not last year or last decade? I don't have an answer to that question, which is why I conclude that refineries are currently facing capacity constraints.

So, the gas tax holiday, were it to be enacted, would do little more than increase oil refinery profits. Consumers would not see any price reduction. This conclusion will be wrong if refineries can find capacity to process more oil, but I don't see any signs of that in the near future.

I made the price margin graph using this R code.

Subscribe to Ag Data News

Agriculture, Economics, and Data