How Much Did Soybean Farmers Lose in the Trade War?

Soybeans frequently made national news in 2018 and 2019 as a centerpiece in the US trade war with China. During this period, soybean exports to China crashed, prices fell, and the Federal government moved quickly to pay farmers billions of dollars as compensation for their losses.

Last week, Food Policy published a new research paper in which my co-authors and I look back on how the trade war affected soybean markets. We estimate that losses to farmers were much smaller than the compensation payments they received. My excellent co-authors on this paper were UC Davis ARE PhD alumnus and current University of Georgia professor Mike Adjemian, and UC Davis undergraduate alumnus Wendi He.

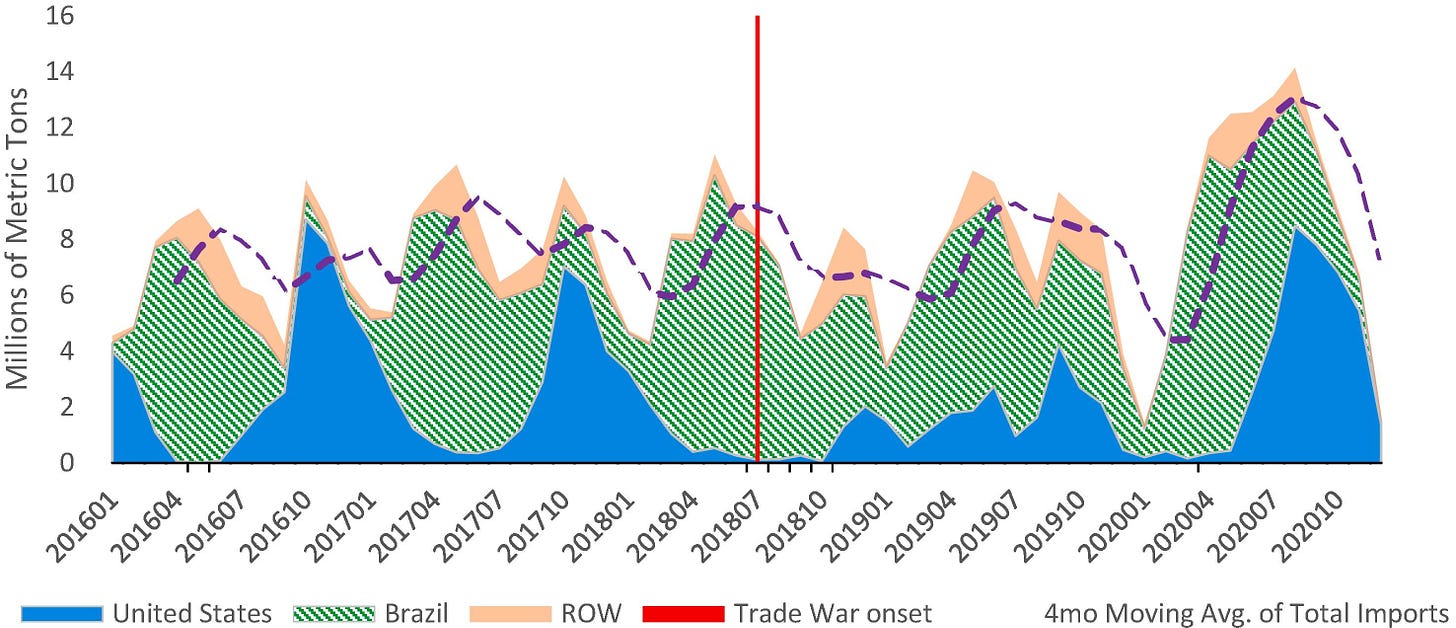

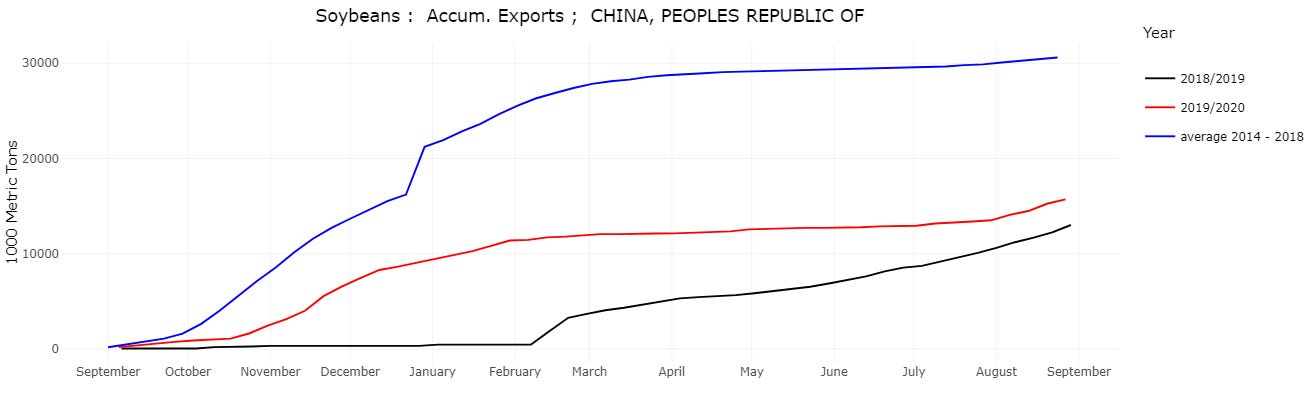

In 2014-17, American farmers produced about $40b of soybeans annually and exported about a quarter of them to China. Then, in 2018, China placed a 25% tariff on US soybeans in retaliation for US trade actions. US soybean exports to China dropped dramatically; they totaled 15.7 million metric tons in 2018-19 and 13.0 million metric tons in 2019-20, each less than half the pre-2018 average.

For more background on soybeans and the trade war, read these two Ag Data News article from last year: Why Soybeans? and China's Buying US Corn Again.

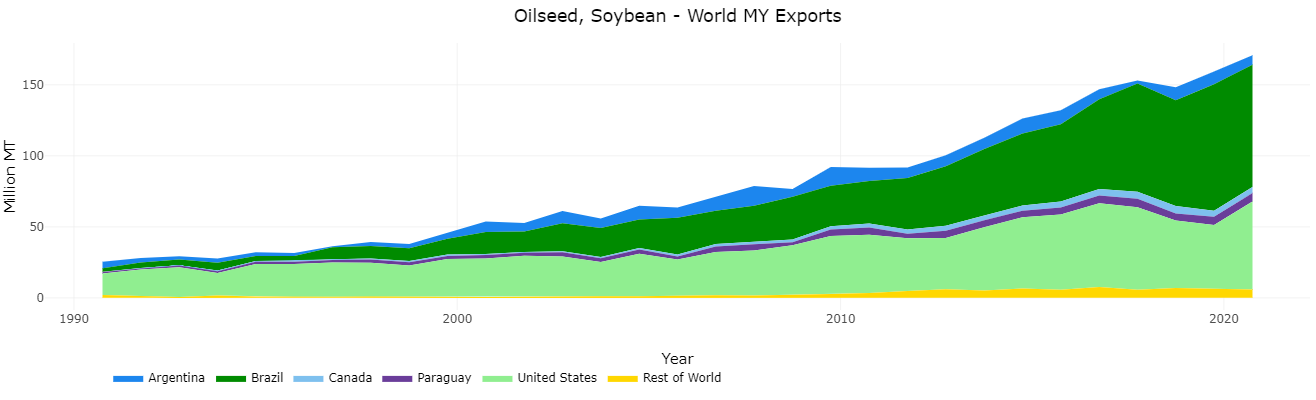

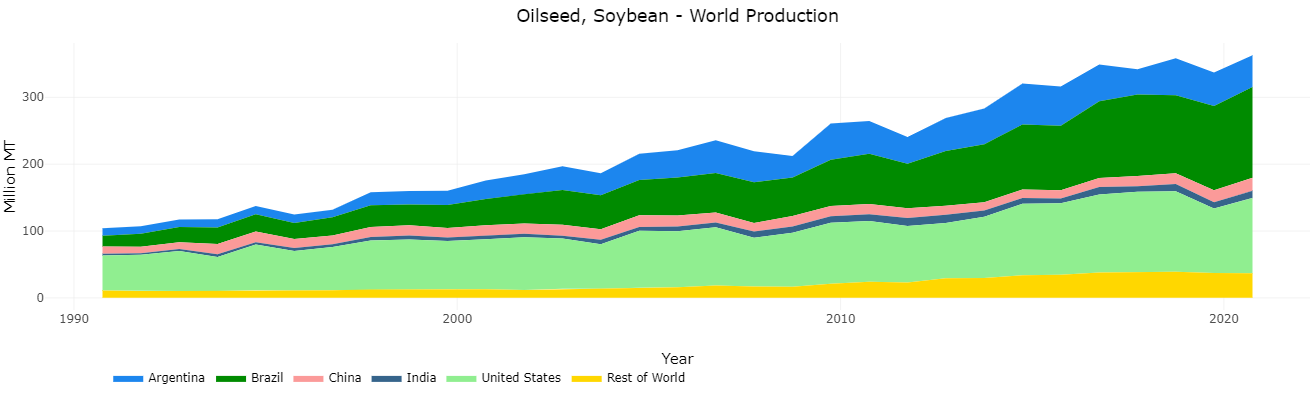

China shifted its soybean purchases from the US to Brazil in 2018 and 2019, but it kept total imports at pre-2018 levels. Together, the US and Brazil account for about 85% of world soybean exports and 75% of world soybean production, so no other countries were positioned to meet China's demand.

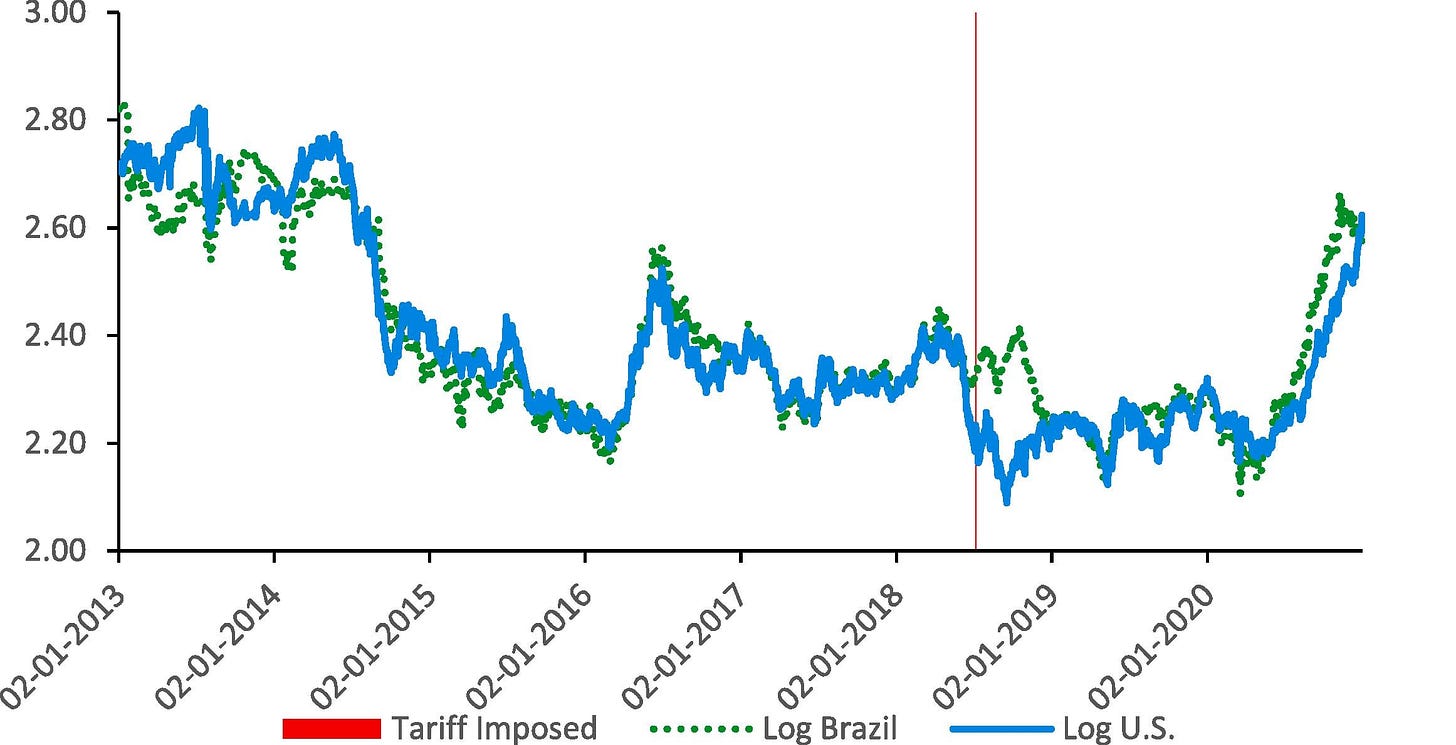

If the US and Brazil could costlessly reshuffle where they sent their soybeans, then the trade war would not have affected soybean prices. There would have been a change in who is buying from whom, but not change in total exports or imports by any country. However, if such reshuffling is costly, then we would expect US prices to drop, as US farmers bear the cost of finding new markets, and Brazil prices to rise, as Brazilian farmers scramble to meet the new demand.

The graph below shows US and Brazil soybean prices on a log scale, which means that each 0.2 increment is about a 20% price difference. After China imposed tariffs, US prices decreased Brazil prices increased to the point where prices in Brazil were almost 25% higher than their US counterparts. The price gap is constrained by the tariff; if Brazil soybeans are 25% more expensive than US soybeans then buying from the US and paying the tariff is the same as buying from Brazil without the tariff.

To estimate the how much US prices declined and Brazil prices increased, we use the Relative Price of Substitute method, which Colin Carter and I developed in a paper on StarLink corn. This method has two parts. First, we look for periods in which the US-Brazil price gap is abnormally large. We find that the price gap was larger than normal from late-June through late-November 2018. During this period, the average relative price decline was 17.6%, which is less than the 25% tariff. It reverted to normal after November 2018.

Second, we compare actual prices to what we predict prices would have been without the trade war. We estimate that China’s retaliatory tariff decreased US export prices by about $0.74 per bushel and raised Brazilian prices by about $0.97 per bushel.

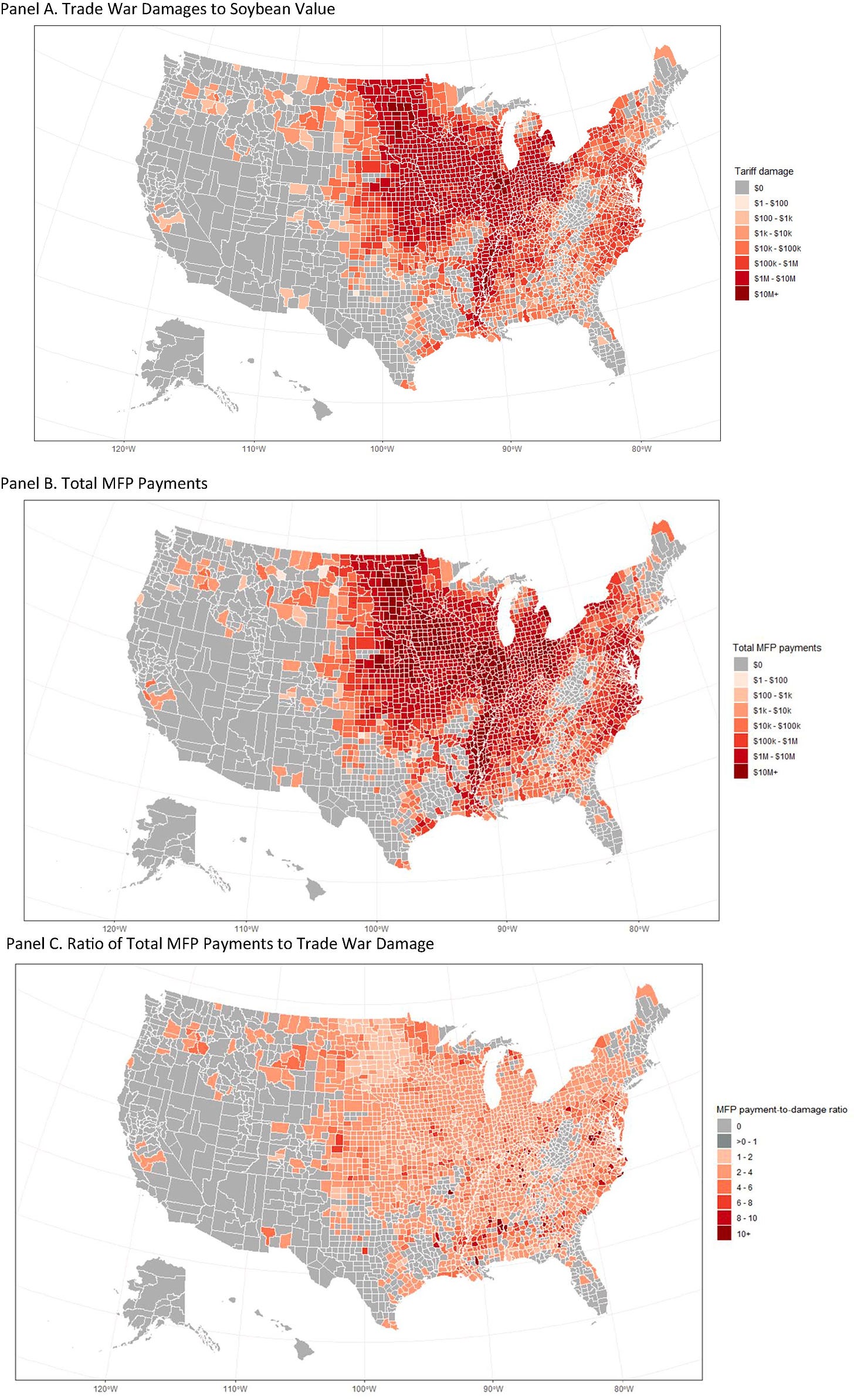

To compensate farmers for lost revenue due to the trade war, the Federal government paid farmers $1.65 per bushel in 2018, which is more than double the damage that we estimate. They applied this payment to almost all 2018 production, whether or not farmers sold (or would have sold) during the five-month period when prices were depressed.

In 2019, when we estimate zero trade war damages, the government paid additional compensation of $2.05 per soybean bushel, although the way it was distributed meant a particular soybean farmer may have gotten more or less depending on how their acreage compared to their county average.

Overall, farmers received several times more in compensation than they lost. For all the details of the trade war compensation program, known as MFP, see this great paper by UC Davis ARE alums Joe Janzen and Nathan Hendricks.

To see weekly data on agricultural exports, see our Export Sales Reports data app. For data on global production and trade of major US commodities such as soybeans, see our World Trends for US Crops data app.

Citation: Estimating the Market Effect of a Trade War: The Case of Soybean Tariffs, Adjemian, M.K,; and Smith, A. Food Policy. 105. 2021.