Egg Prices are Still High, Especially in California

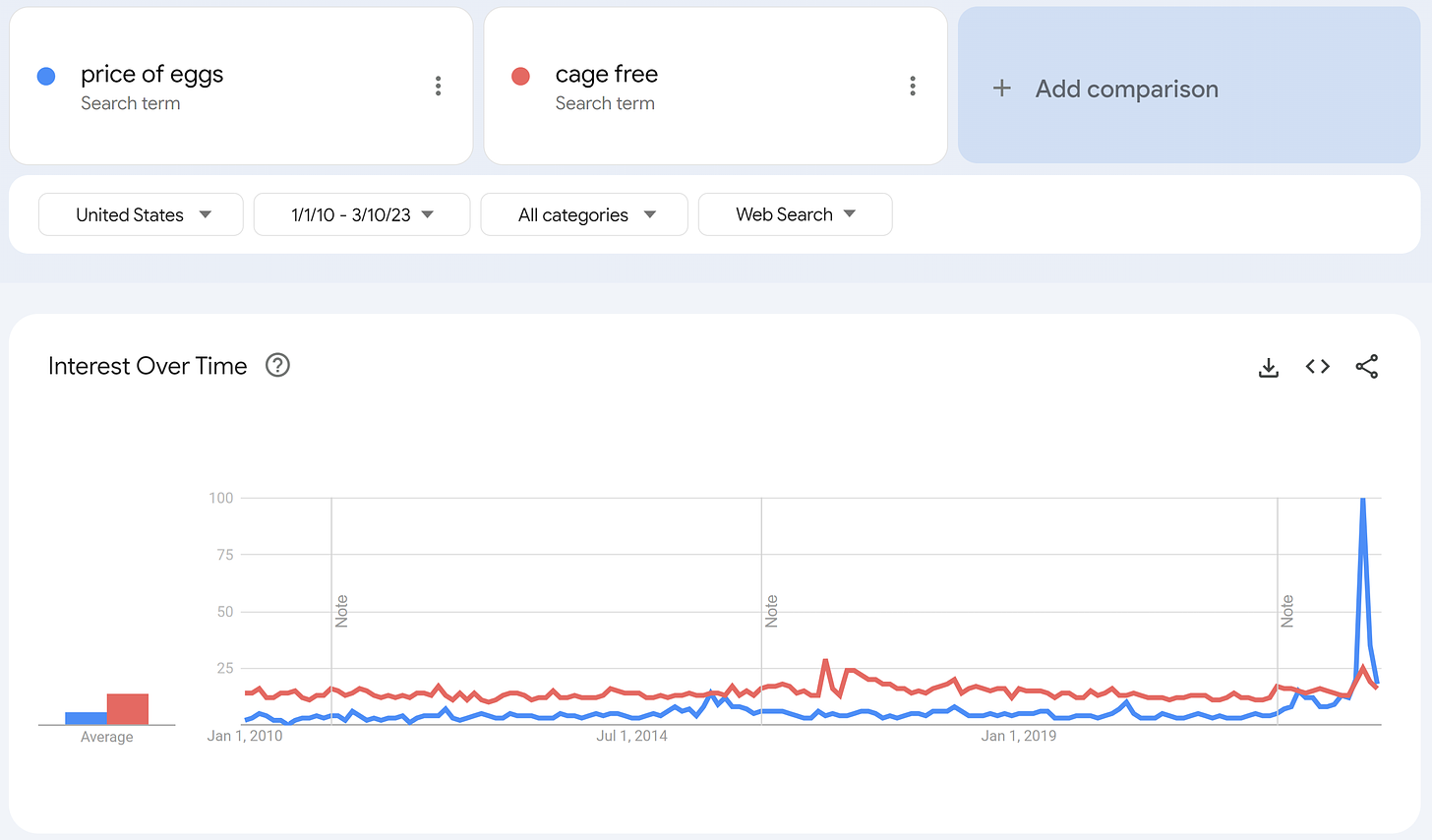

A typical household spends only a few dollars per week on eggs, but seemingly everyone has been talking about egg prices this winter. That is what happens when a product most people buy quintuples in price.

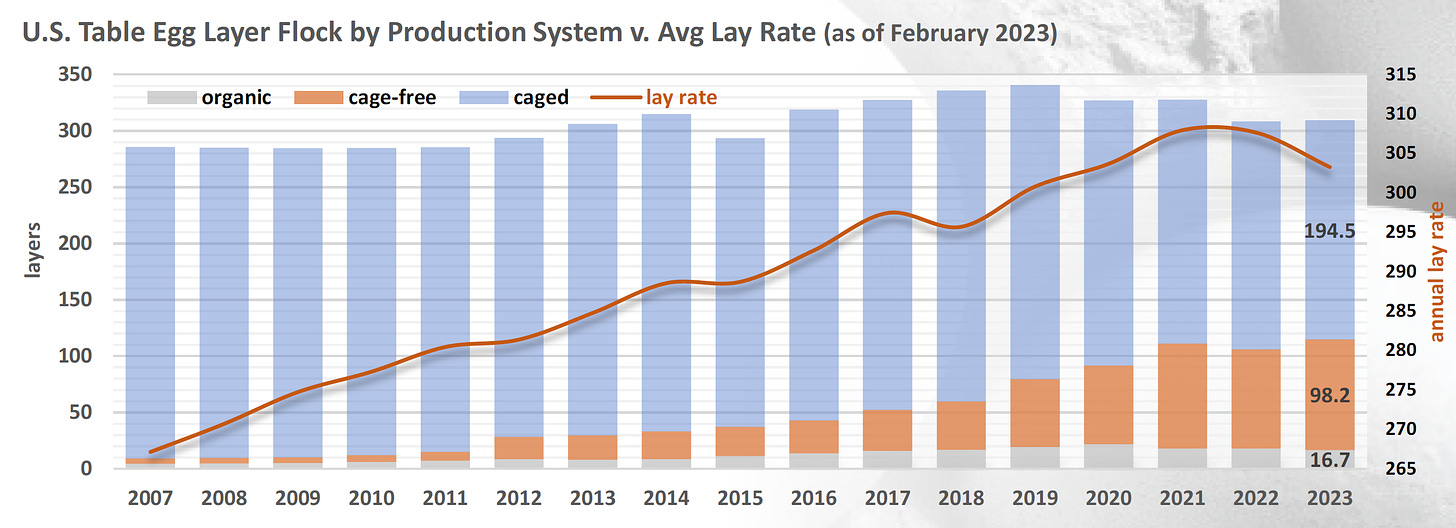

The proximate cause of the price spike was avian flu, which caused millions of chickens to be killed, thereby reducing the supply of eggs. In the background, however, a massive transition is underway as the egg industry moves from caged to cage-free operation. What role did this play in the egg price spike?

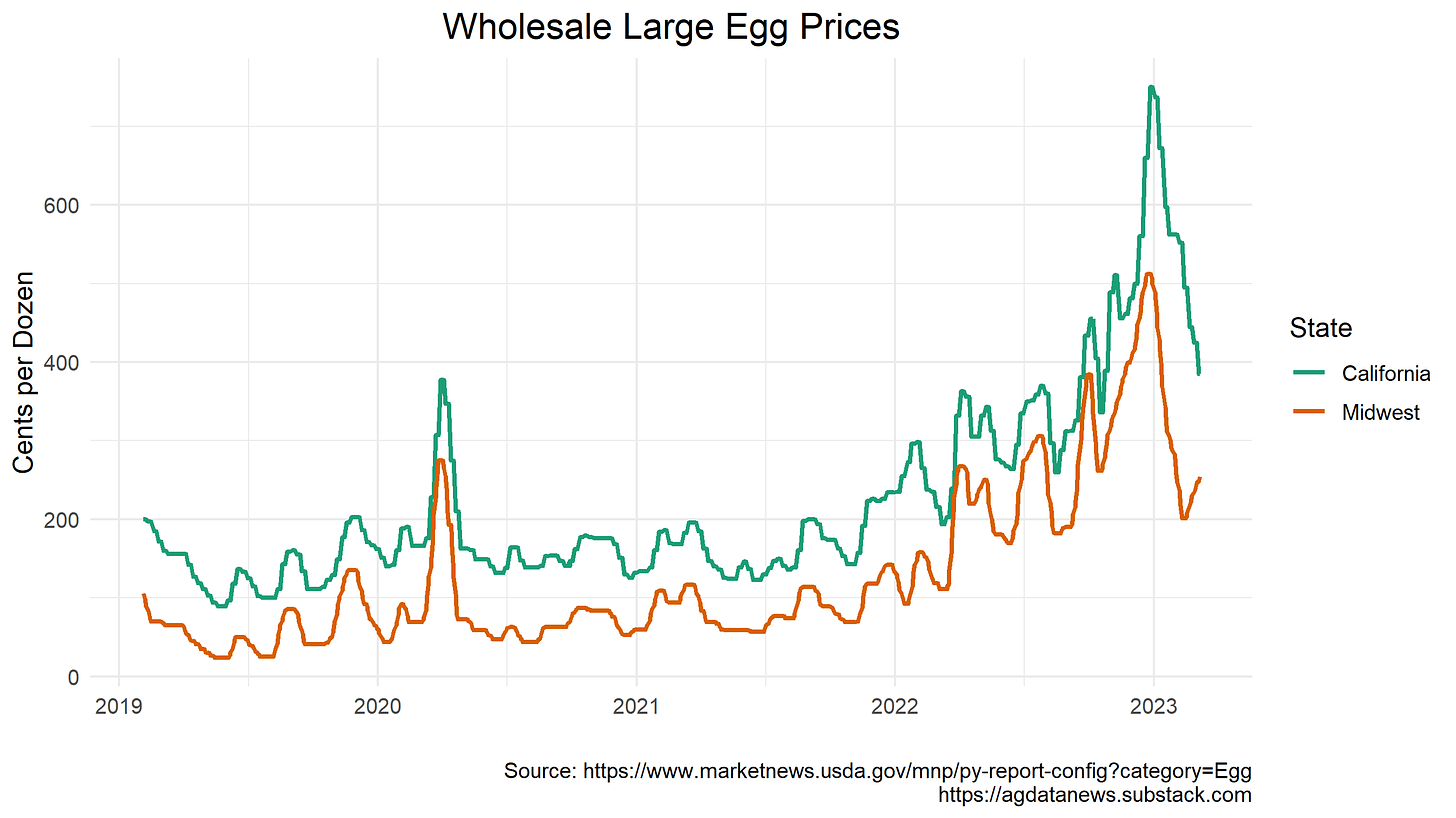

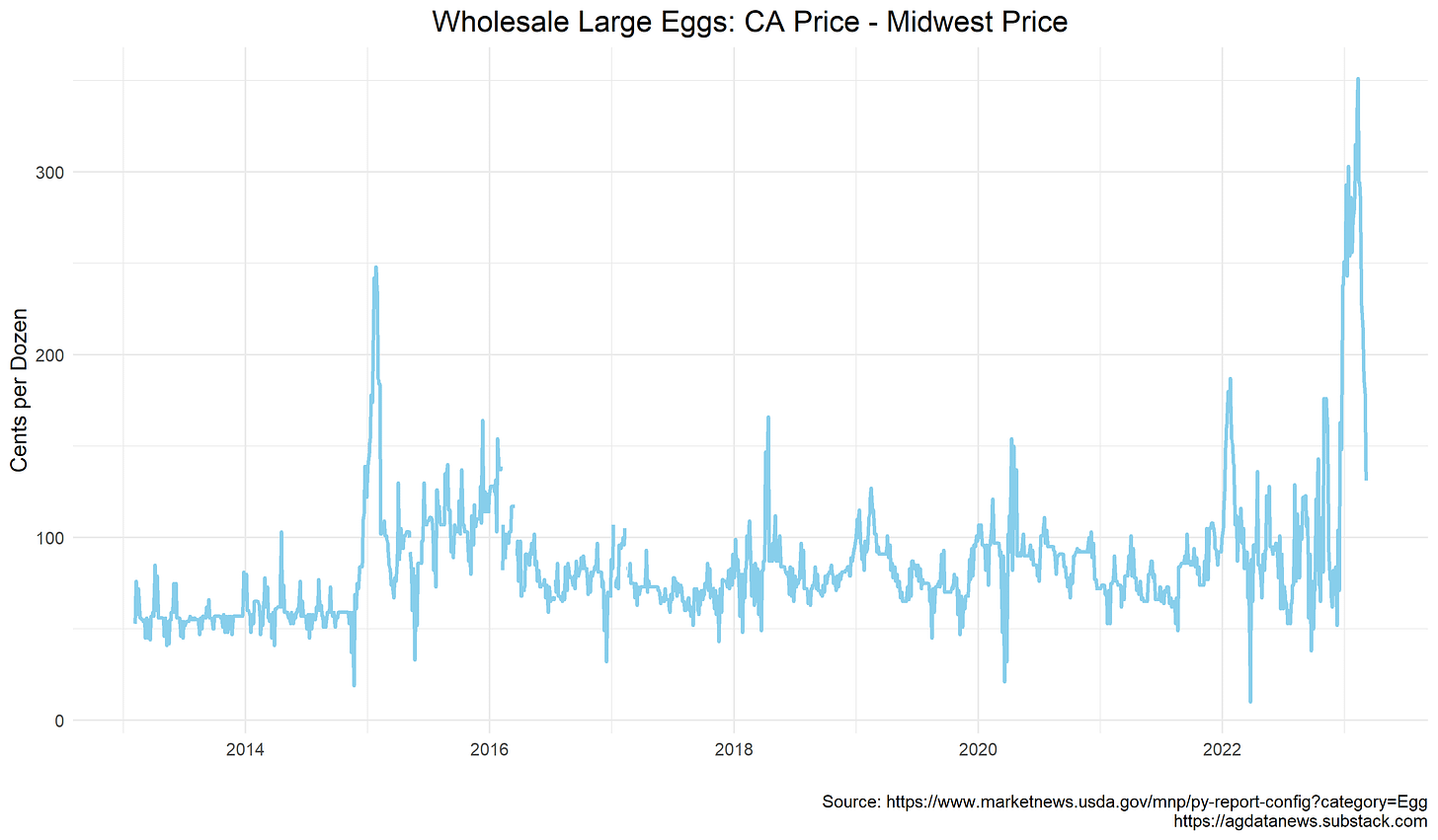

First, the price spike. Wholesale egg prices in the Midwest (defined here as IA, MN, and WI) went from $1 a dozen in early 2022 to $5 by the end of the year. California prices were much higher both before and during the price spike. In 2022, California prices increased from $2 to $7.50 per dozen. Prices have receded from their December peaks, but remain double their pre-spike levels.

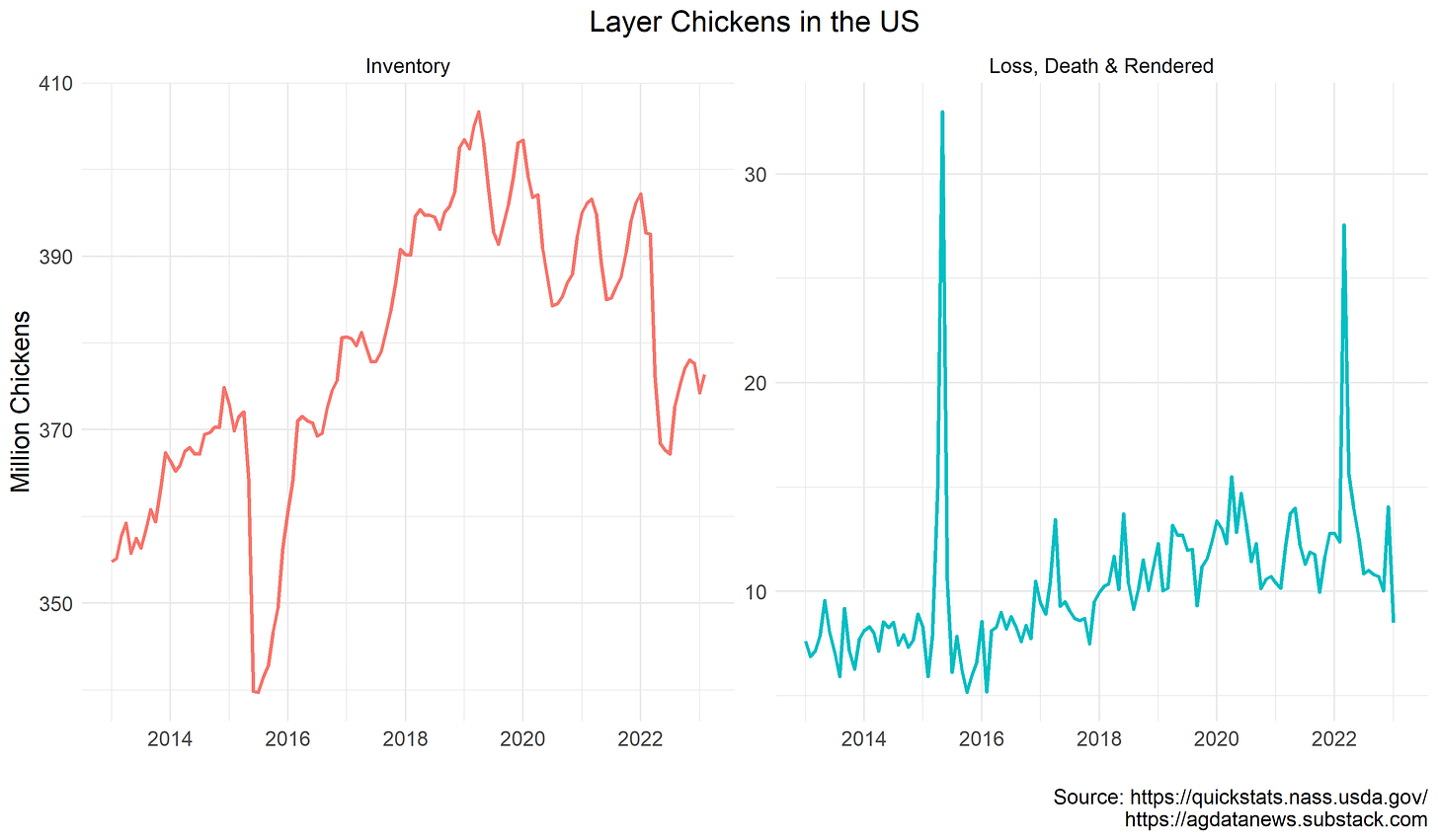

About 40 million table egg hens were affected by the 2022 bird flu, which is similar to the number affected by the last avian flu outbreak in 2015. The US remains down about 20 million layers. As layer inventory recovers this year, egg prices will continue to decline, although they will not likely reach their 2021 levels as long as grain prices remain high (layers eat grain). In addition, inflation means we should expect prices throughout the economy in 2023 to be 10-15% above their 2021 levels.

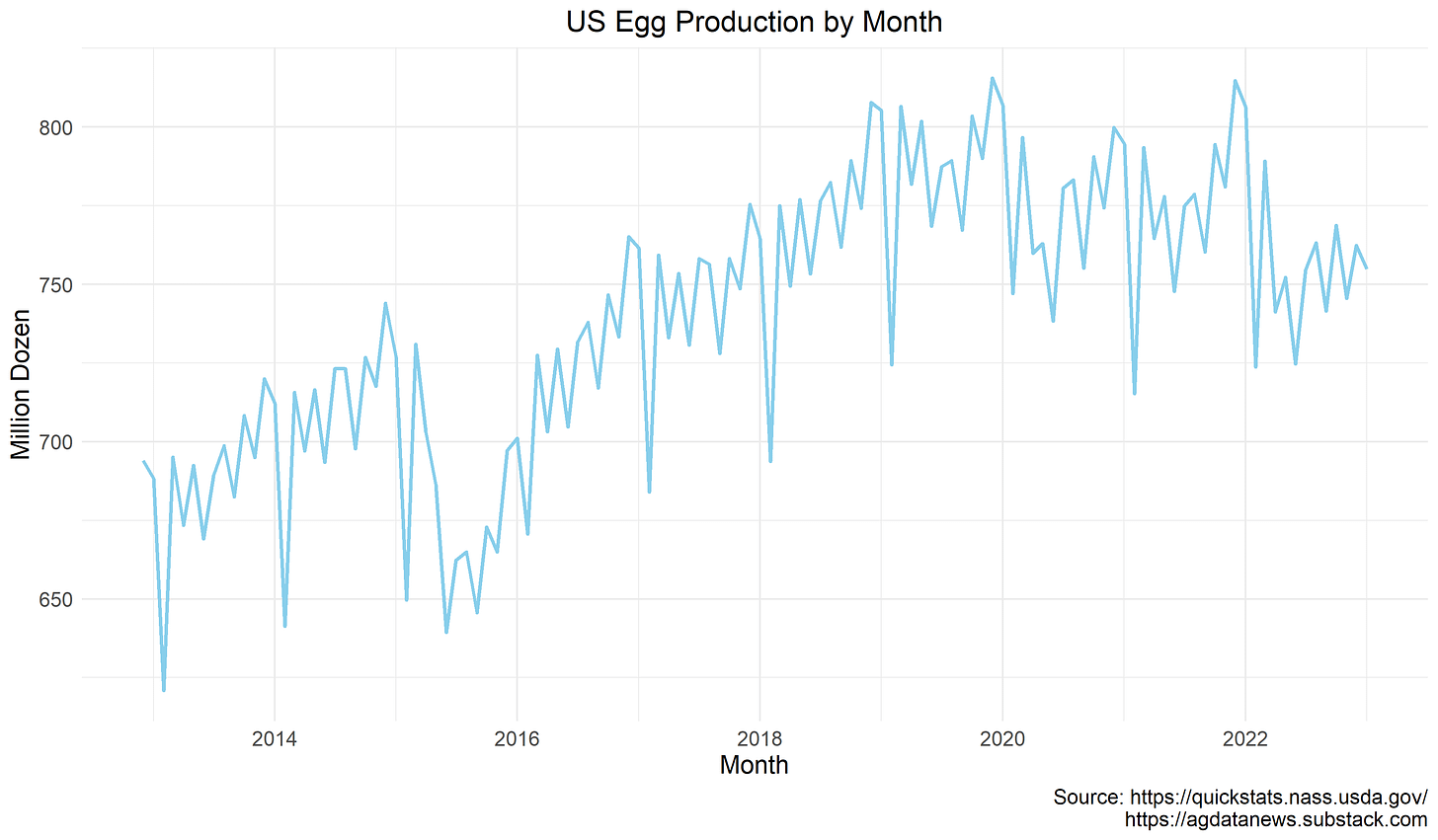

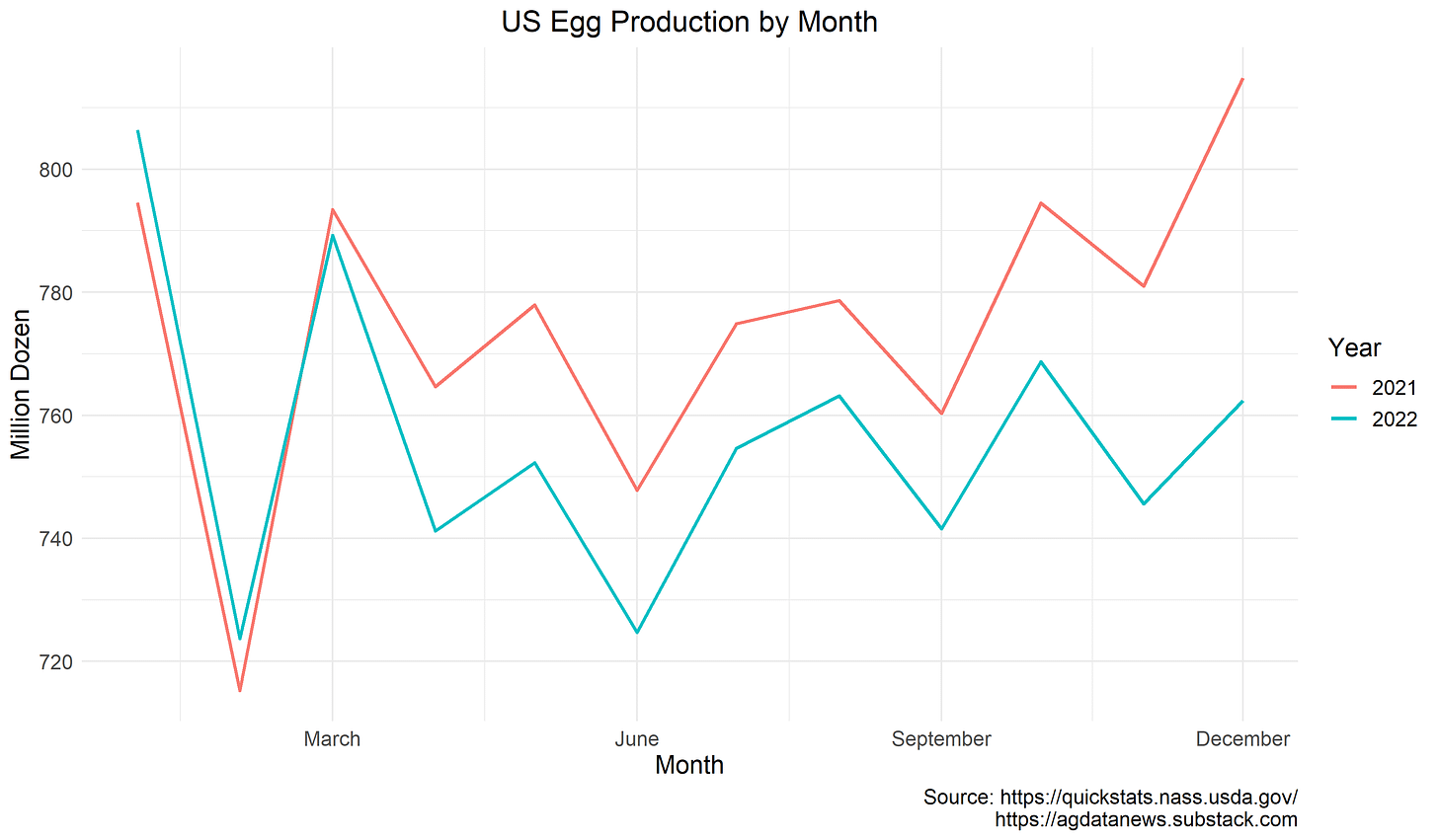

It took a year for egg production to recover after the 2015 avian flu outbreak.

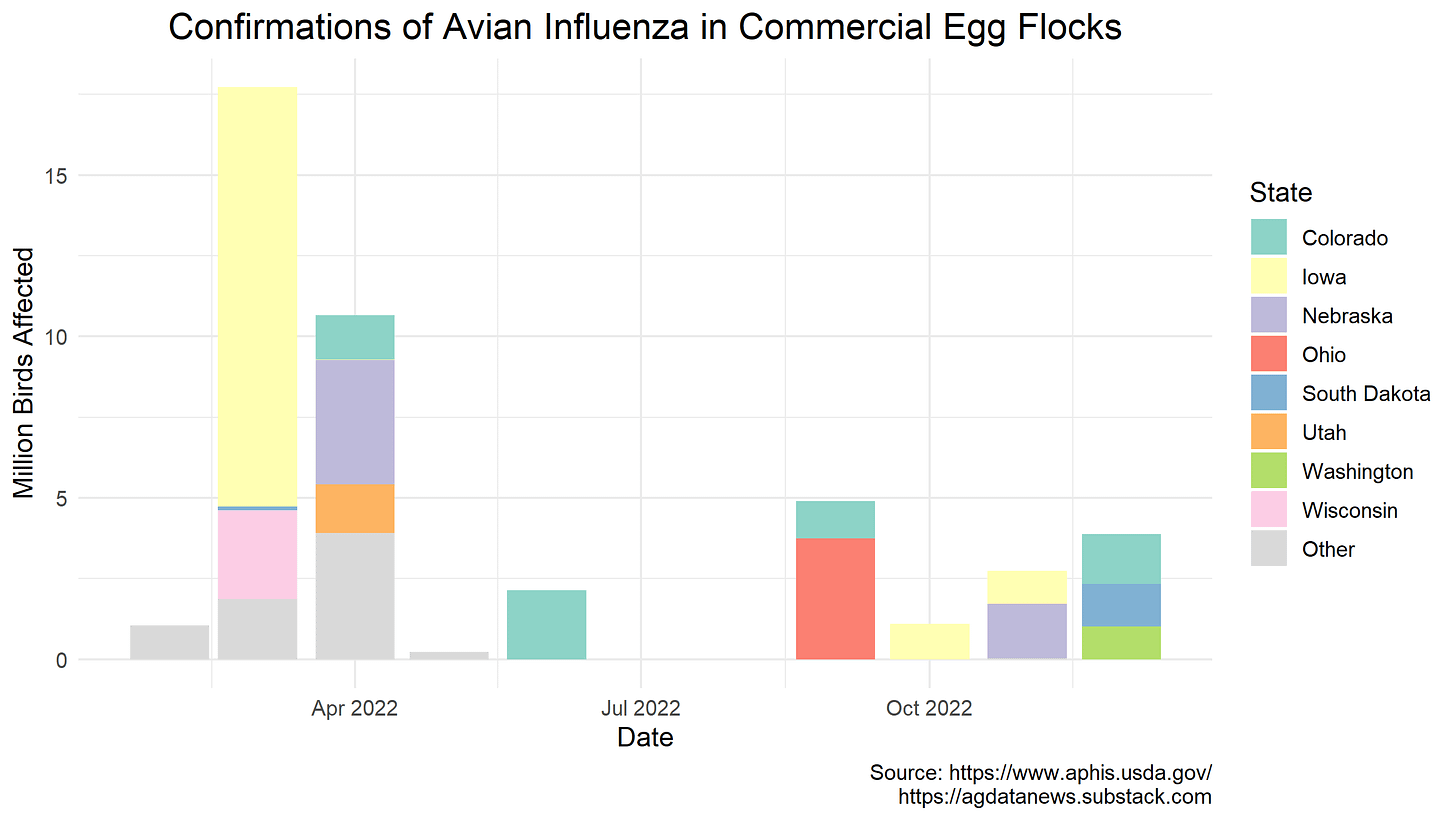

The 2022 outbreak hit first and hardest in Iowa in March 2022. That month, 13 million Iowa layers were confirmed infected, including two facilities containing 5 million birds each. There were additional confirmed infections in April, and in the late summer and fall.

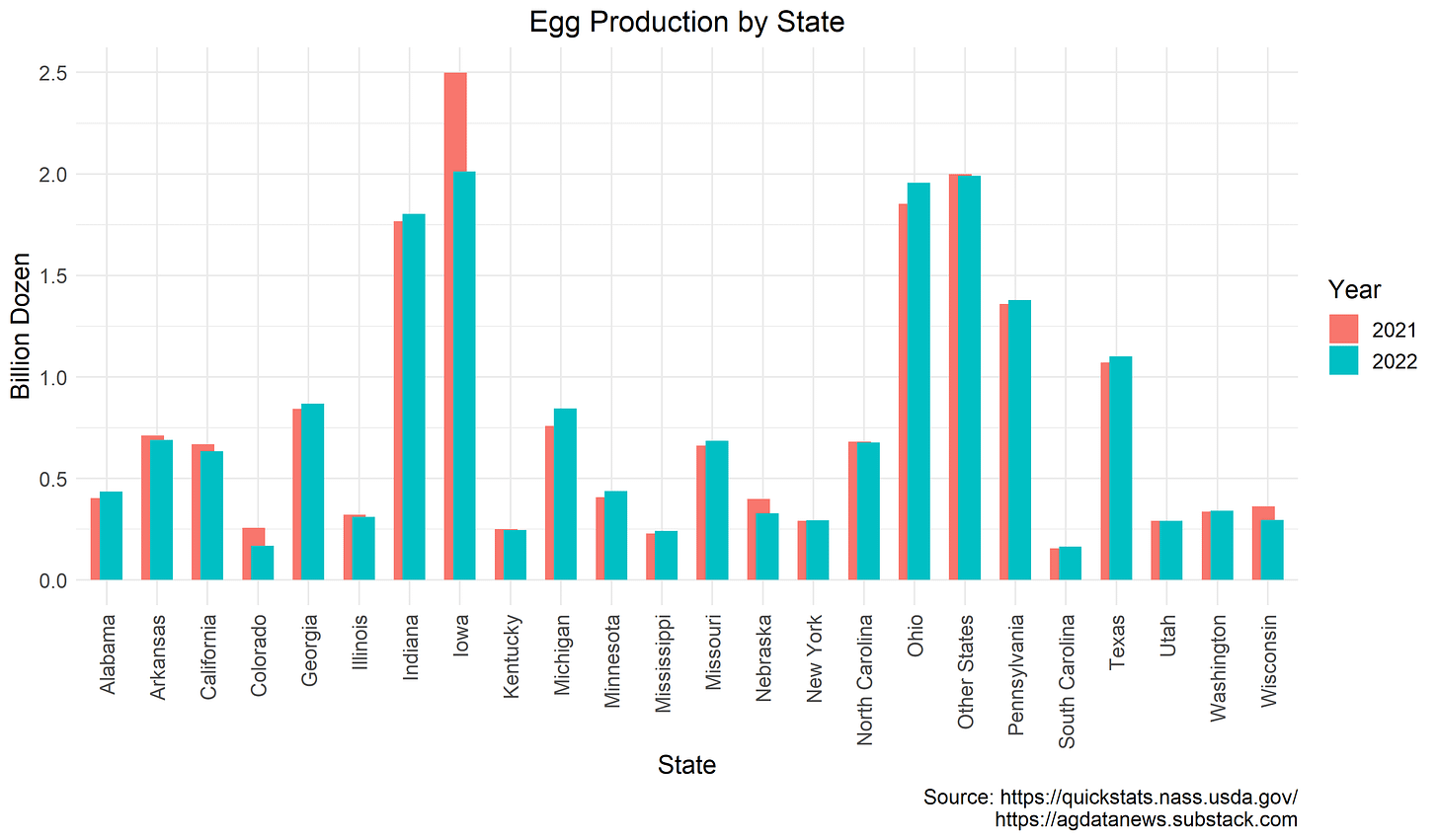

Iowa is the nation's largest egg producer, and it is the only state to show a substantial reduction in egg production in 2022.

Egg prices increased in March 2022 when the avian flu first hit. They increased further late in the year as the fact that people like to eat more eggs during the holidays collided with the fact that supply was 6% below normal.

Prior to 2015, California prices averaged about 60c per dozen higher than the Midwest, likely because most California eggs are produced in the Midwest and need to be shipped from there to here. Starting in 2015, the Prevention of Farm Animal Cruelty Act (PFACA) required producers selling eggs in California to provide egg-laying hens with enough space to turn around and move their limbs.

This requirement stemmed from Proposition 2, which California voters passed in 2008. Under the PFACA, California prices have been 85c above Midwest prices. It seems clear the PFACA raised the cost of producing eggs for California by 25c per dozen.

In 2018, California voters took it one step further by passing Proposition 12, which requires animals held in buildings to "be housed in confinement systems that comply with specific standards for freedom of movement, cage-free design, and minimum floor space." This requirement took effect for eggs on January 1, 2022.

In 2022 after Proposition 12 took effect, California wholesale egg prices averaged $1 higher than Midwest, up from a 85c gap in 2015-2021. This increase suggests that Proposition 12 has added about 15c per dozen to California egg prices. Cage-free egg production is more expensive because hens that move more eat more and because disease spreads more easily. The price spread was more volatile in 2022 than before, perhaps indicating that the cage-free market is thin, i.e., more easily disrupted.

The gap between California and Midwest prices did not change much during the 2022 price run-up, which suggests that cage-free production was affected similarly to caged production. An examination of the USDA Cage Free Shell Egg Report implies that the percentage loss of cage-free layers was similar to the loss of caged layers, which is consistent with similar price runups in the two markets in 2022.

However, everything changed in January 2023 when Midwest prices dropped much faster than California prices, causing the price spread to balloon to $3 (as shown in the chart above). This suggests cage-free production has been slower to recover.

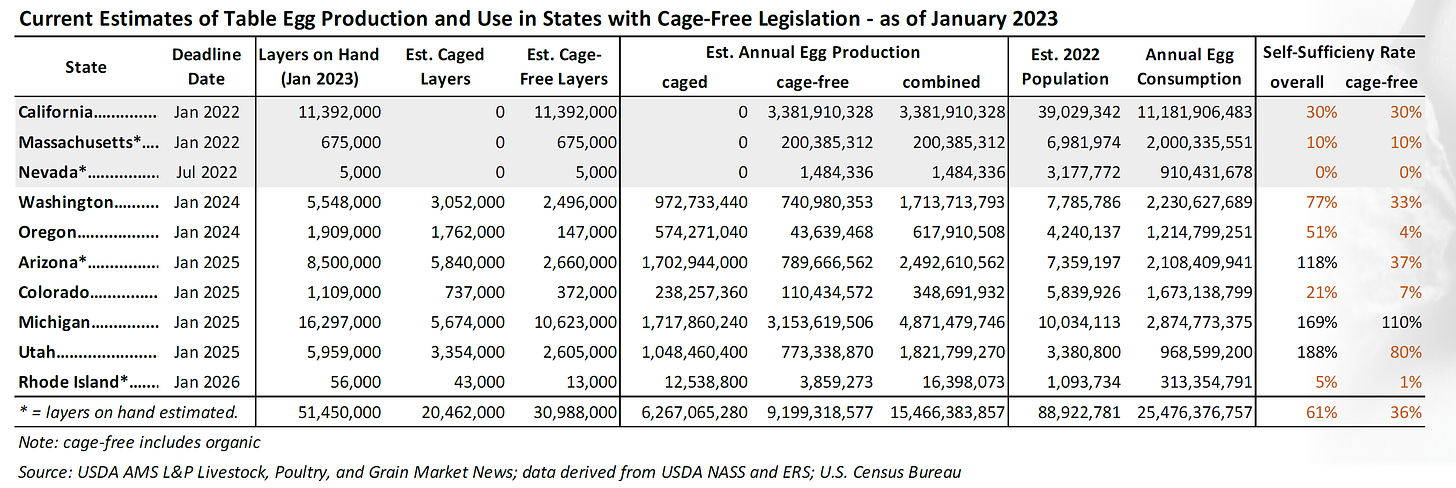

Three states currently have cage-free egg requirements: California, Massachusetts, and Nevada. An additional seven states are slated to join them in the next couple of years. Most of the eggs consumed in these states are produced in other states, so these regulations affect producers throughout the country. At present, California produces 30% of the eggs consumed in the state; the remainder come from states such as Iowa.

Almost 40% of layers in the US are now kept in cage-free systems, up from 18% five years ago and 10% a decade ago. It seems likely this trend will continue as more states adopt cage-free requirements.

The egg price boom is not over, but I expect production to be back to normal levels in the next couple of months. California prices have been slower to decline as cage-free production has been slower to return. As cage-free production continues to grow in the coming years, I expect price differences across the US to dissipate and all of us to pay a little more for our eggs.

I made the graphs in this article using this R code.

Addendum

Proposition 12 also applies to hogs (which I wrote about here), but litigation has held up its implementation for pork products. The National Pork Producers Council and the American Farm Bureau Federation have sued on the grounds that, by imposing rules on farmers in other states, Proposition 12 violates the Commerce Clause of the constitution. The Supreme Court heard oral arguments on this case in October 2023 and is expected to issue a decision soon.

Notes

Ag Data News has been more of a bi-weekly thing than a weekly thing recently, as I've been busy teaching classes and the like. In the coming weeks, I plan to get back to writing shorter weekly articles rather than less frequent long ones.

Here's my case for why we should keep our system of daylight saving: Daylight Saving is Good, Actually