Are We Running Out Of Chickpeas?

In 2019, The Atlantic published an article titled "In the Future, Everything Will Be Made of Chickpeas". The humble chickpea --- also known as the garbanzo bean --- is relatively high in protein, which makes it attractive to people looking to avoid eating animal products. It is the main ingredient in hummus, which has become a popular snack food. Google searches for "chickpea" have more than tripled in the past decade.

Yet, US chickpea production is declining, the hummus shelves at the grocery store have been empty, and media outlets are warning of shortages. Is the chickpea boom over? Are we facing a hummus shortage?

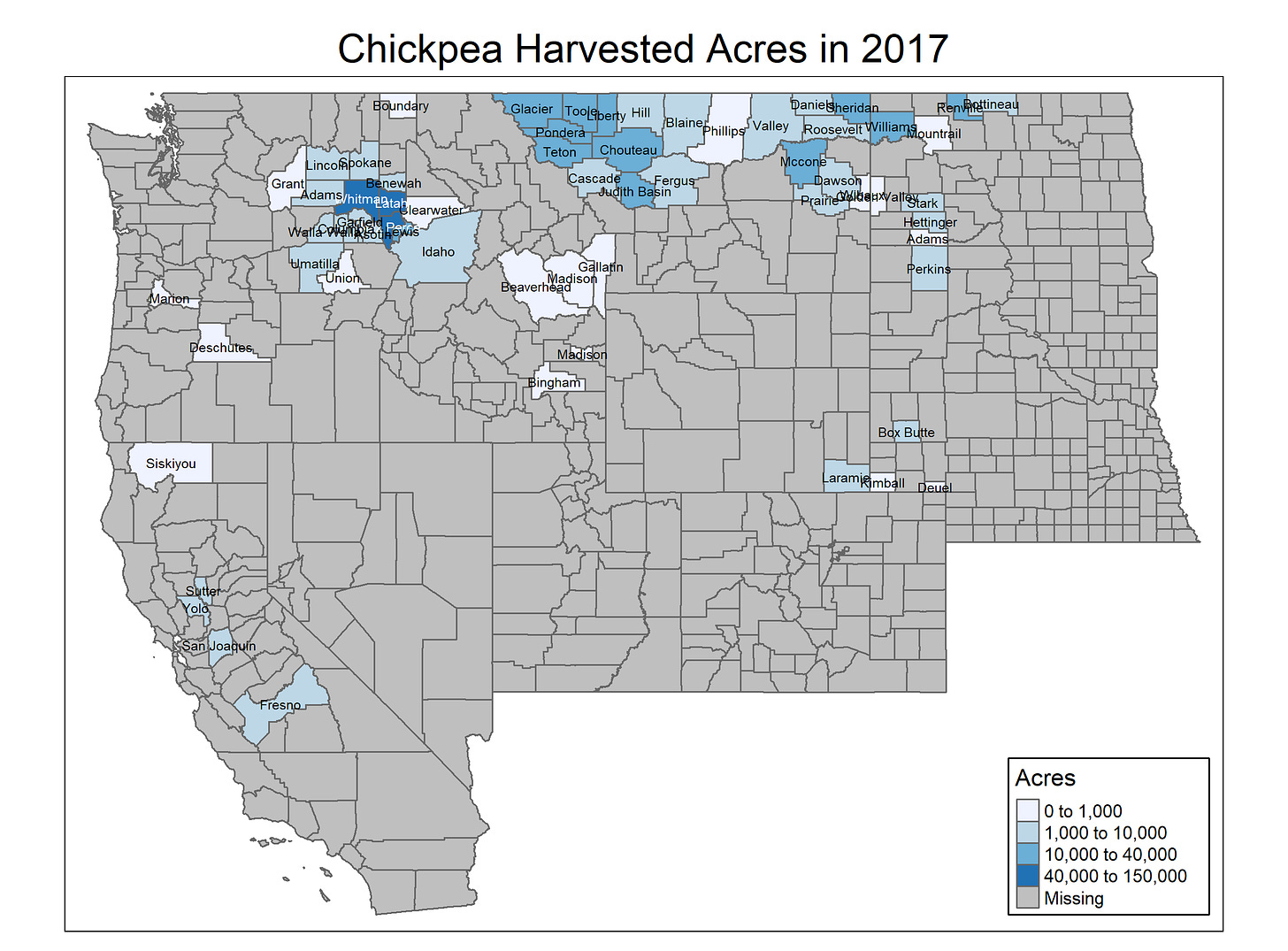

Chickpeas in the US are produced mainly in three states: Washington, Idaho, and Montana. This region is also home to other pulse crops such as peas and lentils. There is a small amount of chickpea production in California (of course there is), Nebraska and the Dakotas.

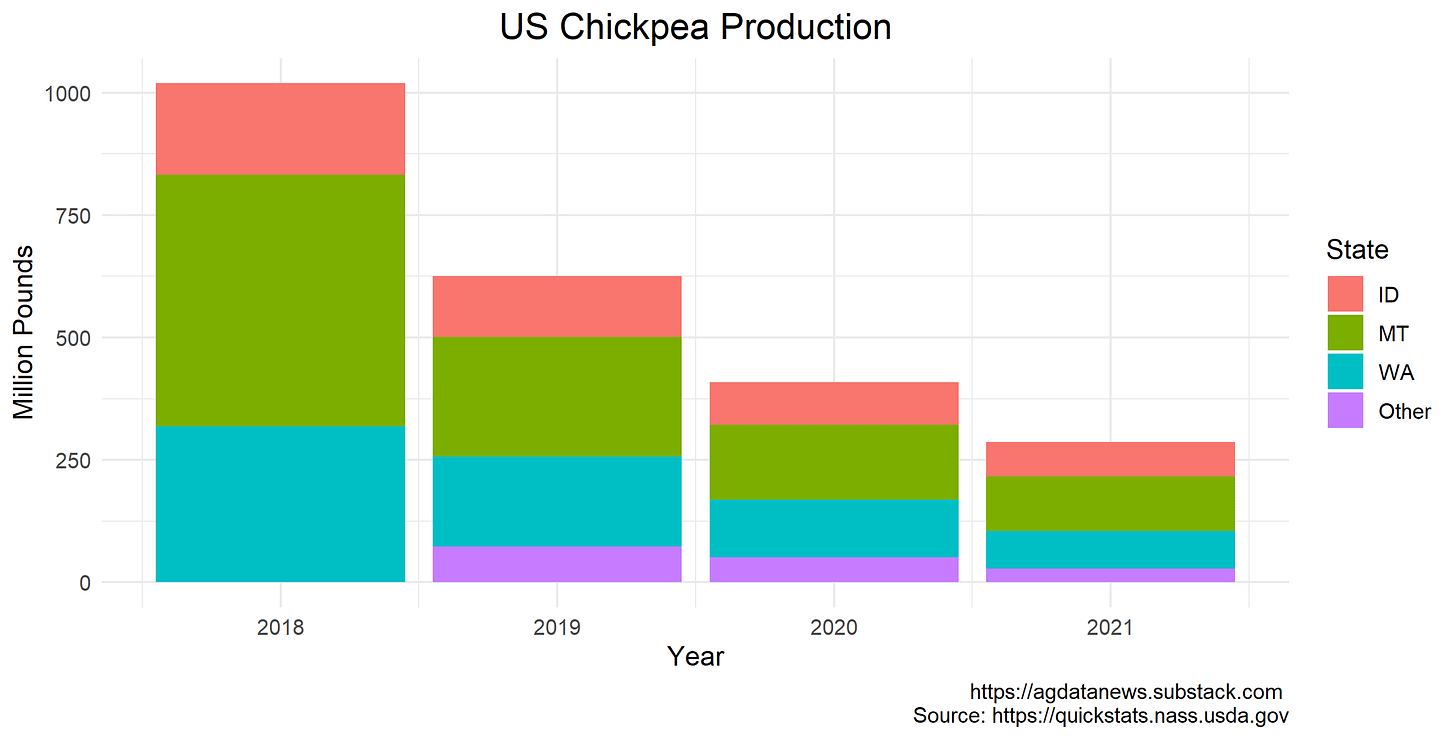

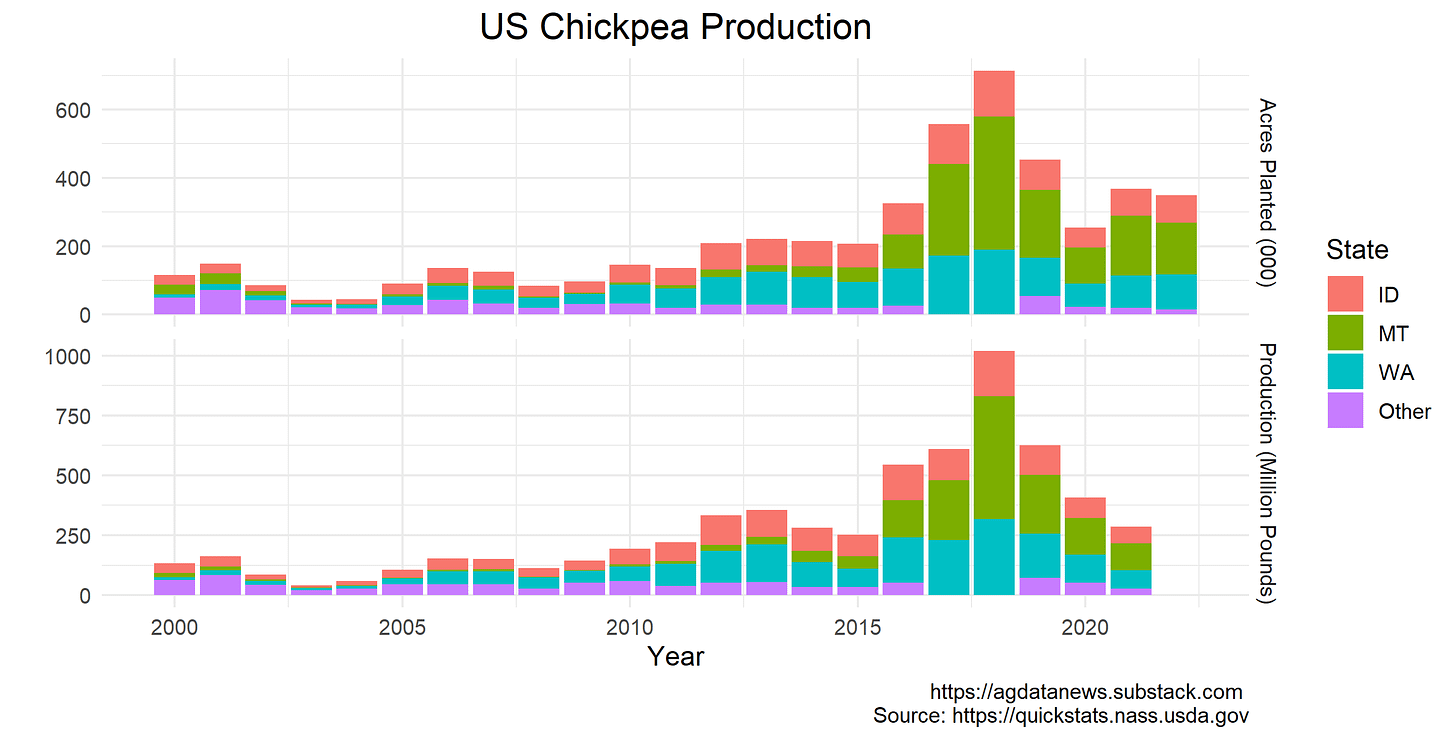

US chickpea production increased sharply between 2015 and 2018 in response to growing export demand and the resulting high prices. In this period, production quadrupled from 250 million pounds to a billion pounds. Acreage dropped precipitously in 2019 and 2020, before rebounding somewhat in 2021 and 2022. Although 2021 acreage was higher than 2020, production did not increase that year because of a drought that devastated agricultural production in the upper great plains.

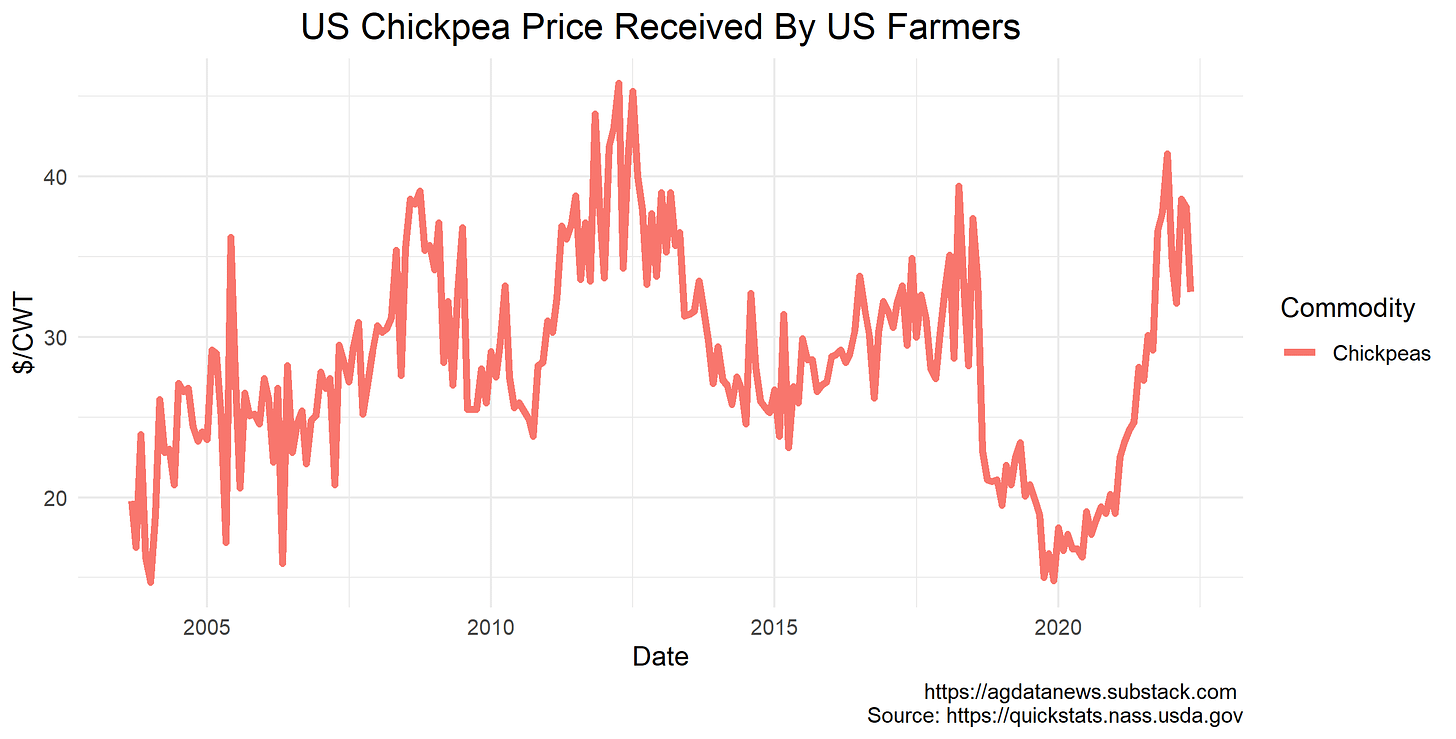

The proximate cause of the production drop was a price decrease. Following the huge 2018 crop, prices went from 40 to 20 cents per pound. Farmers cut back acreage in 2019 and 2020 because 20c/lb was not a high enough price to make a profit. In May of this year, which is the latest USDA data, the price was 32.8c, down from 41.4c in December 2021. These prices show no indication of growing concern about a chickpea shortage. Prices recovered in 2021.

Note on pricing units: You may see prices reported as, say, $32.80 per hundredweight (CWT) or 32.8c/lb. A hundredweight is 100 pounds.

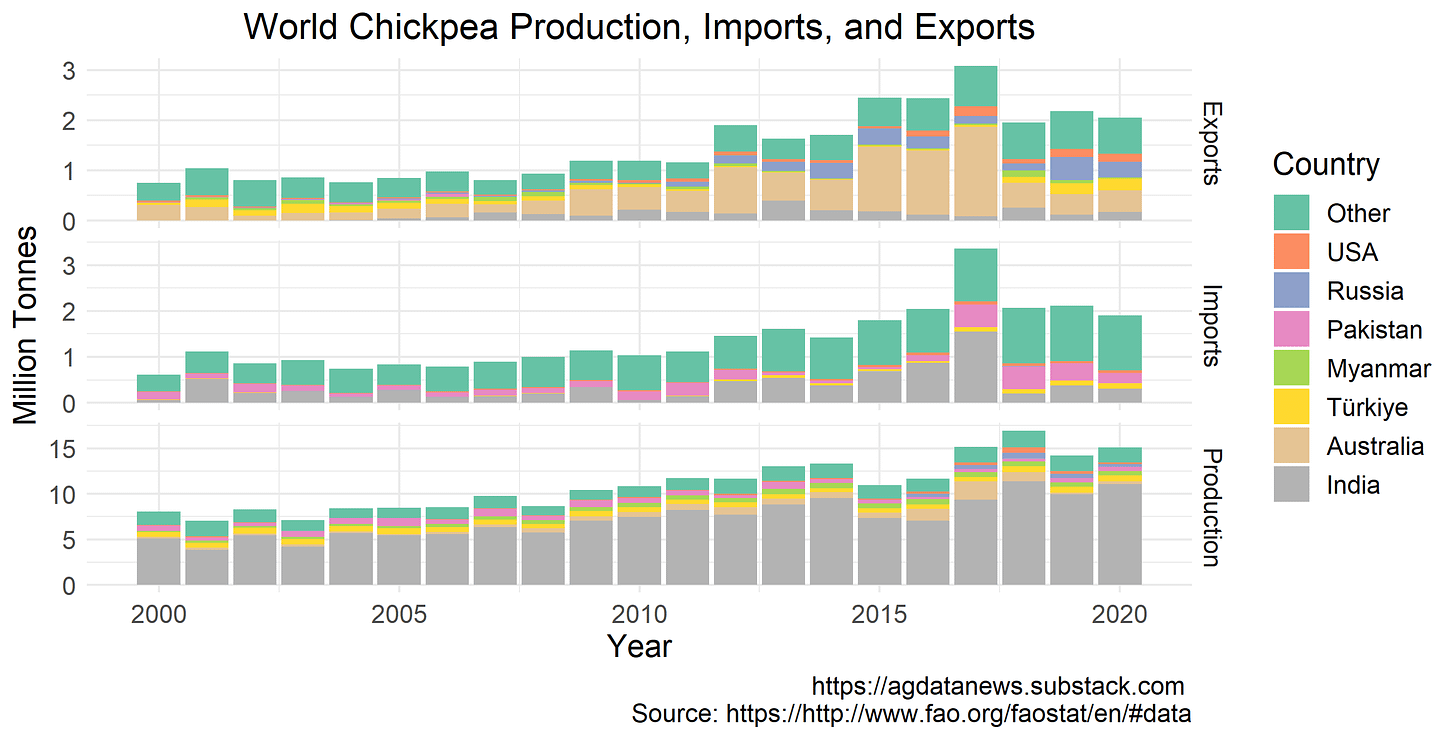

In December 2017, India imposed a 30% tariff on chickpeas, which it increased to 60% in 2018. The Indian government aimed to reduce imports into India and therefore raise prices inside India. To the rest of the world, the tariffs presented as a decrease in demand and therefore a decrease in prices. As a result, production declined in major exporting countries, especially Australia.

In the wake of Russia's invasion of Ukraine, it is tempting to blame all shortages and price shocks on the invasion. I have argued previously that the war's effects on food prices have often been overstated, especially for vegetable oils. One mistake is to report the percent of world exports that Russia contributes rather than the percent of world production. Russia accounts for 15% of world chickpea exports, but only 2% of world chickpea production. If Russia's production is lost to world markets, it can be replaced relatively easily.

The panicked media reports about running out of hummus suggest that there will continue to be plenty of Americans wanting to eat chickpeas. Factors like post-pandemic supply chain bottlenecks and factory closures have affected chickpea availability, and will continue to affect it. However, crop conditions in the US have been much better this growing season than in 2021, which suggests plentiful chickpeas after the crop is harvested in the next few months. Australia's 2022 crop was planted a couple of months ago and is projected to be smaller than in 2021 because high wheat prices have incentivized planting more wheat, but large stockpiles of chickpeas remain on farms in Australia.

All that said, the above production chart reveals that chickpeas are all about India. India grows 75% of the world's supply and, as a net importer, consumes even more. Before imposing tariffs in 2018, it accounted for half of world imports. India's next crop will be planted around October and harvested early next year. I'm not seeing signs of extensive shortages, but as India goes, so will the chickpea market.

I made the figures in this article using this R code.